How Does The Total Debt Servicing Ratio (TDSR) Affect My Property Loan Eligibility In Singapore?

Understanding TDSR: Your Comprehensive Guide to Total Debt Servicing Ratio. Introduced in Singapore, the Total Debt Servicing Ratio (TDSR) is a critical financial metric that plays a significant role in the loan application process for individuals seeking to take on debt in Singapore.

This article delves into the intricacies of TDSR, explaining its importance, how it is calculated, and its implications for various types of loans, including personal and property loans.

Understanding TDSR is essential for anyone looking to manage their debt responsibly, ensuring they do not overextend themselves financially.

This guide will equip you with the knowledge to navigate the complexities of borrowing in Singapore, making it a must-read for potential borrowers.

Why is TDSR Important in Singapore?

TDSR plays a crucial role in maintaining financial stability within Singapore’s economy. By regulating how much debt individuals can take on relative to their income, it helps prevent situations where borrowers commit to debt levels that exceed their repayment capabilities.

This is particularly important given the rising property prices and increasing living costs in Singapore. Additionally, understanding your TDSR can empower you as a borrower.

It enables you to make informed decisions about your finances, ensuring that you do not overextend yourself when applying for loans.

A well-managed TDSR can also improve your chances of loan approval, as lenders will view you as a lower-risk borrower.

How is TDSR Calculated?

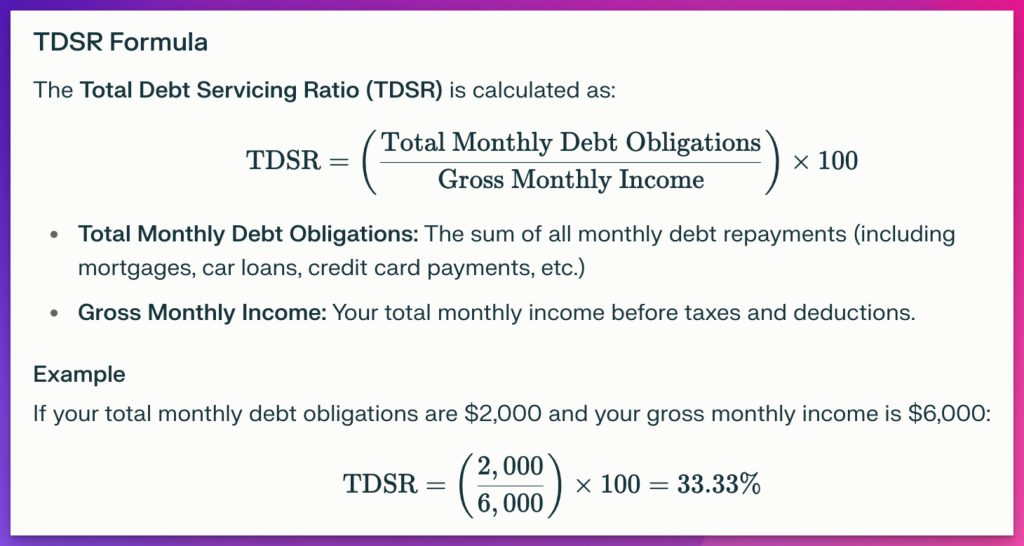

Calculating your Total Debt Servicing Ratio involves dividing your total monthly debt obligations by your gross monthly income.

The formula can be expressed as:

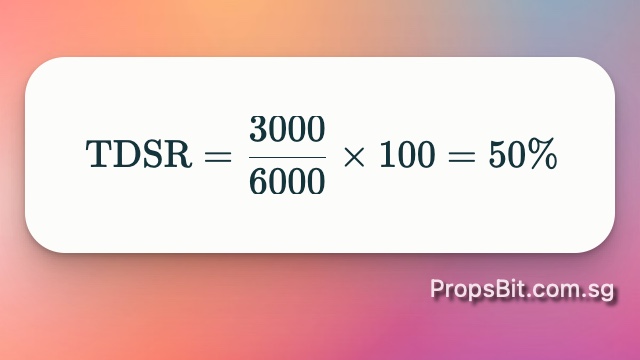

For example, if your total monthly debt obligations amount to SGD 3,000 and your gross monthly income is SGD 6,000, your TDSR would be:

This calculation illustrates how much of your income goes towards servicing your debts. It’s essential for potential borrowers to keep track of their existing debts and ensure they remain within the acceptable limits set by financial institutions.

What are the TDSR Rules?

The rules governing the Total Debt Servicing Ratio are designed to protect both borrowers and lenders. Here are some key aspects:

- TDSR Limit: Borrowers must maintain a TDSR below 55%. If your ratio exceeds this threshold, you may be denied additional loans or face stricter lending conditions.

- Inclusion of All Debts: When calculating your TDSR, all forms of monthly debt obligations must be included. This encompasses housing loans, personal loans, car loans, credit card payments, and any other recurring debts.

- Income Considerations: Only gross monthly income is considered when calculating the ratio. This includes salaries, bonuses, and any other regular income sources.

These rules ensure that borrowers do not take on excessive debt relative to their income levels, fostering a more sustainable borrowing environment.

How Does TDSR Affect Your Mortgage Loan Application?

When applying for a loan in Singapore, lenders will assess your TDSR as part of their evaluation process. A lower TDSR indicates that you have more disposable income available after servicing existing debts, making you a more attractive candidate for new loans.

If your calculated TDSR exceeds 55%, lenders may either decline your application or offer you a smaller loan amount than requested. This could significantly impact your plans if you were relying on that loan for significant purchases like property or vehicles.

Additionally, understanding how lenders view your TDSR can help you strategise your loan applications effectively. For instance, paying down existing debts before applying for new financing can improve your ratio and increase your chances of approval.

What Types of Loans are Affected by TDSR?

The Total Debt Servicing Ratio applies to various types of loans in Singapore:

- Home Loans: Mortgages for purchasing property are heavily influenced by the TDSR

framework since housing costs represent significant monthly obligations. - Personal Loans: These unsecured loans also tall under the purview of TDSR calculations.

Financial institutions will consider any outstanding personal loan repayments when assessing

your overall debt burden. - Car Loans: Similar to personal loans, car financing options are evaluated based on their

contribution to total monthly debt obligations.

Understanding how different types of loans contribute to your overall debt picture can help you

manage them effectively while keeping within acceptable limits set by the MAS.

What is the Difference Between TDSR and MSR?

While both Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) serve as measures for assessing borrowing capacity, they focus on different aspects:

| Feature | Total Debt Servicing Ratio (TDSR) | Mortgage Servicing Ratio (MSR) |

|---|---|---|

| Definition | Measures total monthly debt obligations against gross income | Measures only housing-related debts against gross income |

| Applicability | Applies to all types of loans | Specifically applies to housing loans |

| Limit | Maximum 55% | Maximum 30% |

The MSR is particularly relevant for those seeking home financing as it ensures that borrowers do not overcommit themselves solely based on housing expenses.

Understanding both ratios can provide comprehensive insights into managing overall financial health.

How Can You Improve Your TDSR?

Improving your Total Debt Servicing Ratio involves strategic financial planning and management:

- Reduce Existing Debts: Paying off outstanding debts can significantly lower your total

monthly obligations. Focus on high-interest debts first, such as credit card balances. - Increase Income: Exploring opportunities for additional income through side jobs or

promotions can enhance your gross monthly income figure used in the calculation. - Refinance Loans: If possible, consider refinancing existing loans at lower interest rates or

extending loan tenures to reduce monthly repayments.

By actively managing these factors, you can improve your financial standing and create a healthier

borrowing profile.

What are the Exemptions to TDSR?

Certain exemptions exist within the framework of the Total Debt Servicing Ratio rules:

- Investment Property Loans: Some investment property loans may be exempt from being

included in the calculation if they meet specific criteria set by lenders. - Borrowers with High Income: Individuals with exceptionally high incomes may negotiate

terms with lenders that allow them some leeway regarding their calculated ratios.

Understanding these exemptions can provide opportunities for borrowers who might otherwise

struggle with strict adherence to standard guidelines.

Understanding Debt Obligations Under TDSR

Debt obligations encompass all recurring payments that affect an individual’s financial profile:

- Monthly Debt Obligations: This includes payments made towards mortgages, personal

loans, car loans, credit cards, and any other regular financial commitments. - Total Monthly Debt Obligations: The sum total of all these payments forms the basis for

calculating an individual’s Total Debt Servicing Ratio.

Being aware of what constitutes total debt obligations helps borrowers manage their finances

better and stay within acceptable limits when applying for new credit facilities.

What is the Loan-to-Value Ratio (LTV) and How Does it Relate to TDSR?

The Loan-to-Value ratio (LTV) measures how much loan you are taking out compared to the value of the property being purchased:

A higher LTV indicates higher risk for lenders since it suggests less equity in the property being financed. LTV ratios often influence both mortgage approval processes and interest rates offered by lenders.

Maintaining an appropriate LTV ratio alongside managing a healthy Total Debt Servicing Ratio ensures responsible borrowing practices while maximising financing opportunities.

How Does Interest Rate Impact Your TDSR?

Interest rates play a significant role in determining monthly repayment amounts:

- Higher Interest Rates: When interest rates rise, so do monthly repayments on variable-rate

loans. This increase can adversely affect an individual’s Total Debt Servicing Ratio if not

managed carefully. - Fixed vs Variable Rates: Choosing between fixed-rate and variable-rate loans can impact.

long-term affordability; fixed rates provide stability while variable rates may initially offer

lower payments but come with uncertainty over time.

Understanding how interest rates affect overall debt obligations allows borrowers to make

informed choices regarding loan products that align with their financial goals without exceeding

acceptable thresholds set by regulatory bodies like MAS.

What Happens if You Exceed the TDSR Limit?

Exceeding the Total Debt Servicing Ratio limit can have serious implications:

- Loan Application Denial: If a borrower’s calculated ratio exceeds 55%, lenders may deny

new loan applications or offer reduced amounts due to perceived riskiness associated with

additional borrowing commitments. - Stricter Lending Conditions: Even if approved for a loan despite exceeding limits, terms may include higher interest rates or additional collateral requirements, which could strain finances further down the line.

Being proactive about managing debts ensures compliance with established guidelines while

safeguarding future borrowing capabilities essential for achieving long-term financial objectives

effectively.

How Does TDSR Apply to Personal Loans in Singapore?

When applying for personal loans in Singapore:

- All existing debts must be factored into calculating an applicant’s Total Debt Servicing Ratio.

- Lenders will evaluate whether an individual meets established thresholds before approving new financing requests.

- Borrowers should assess their current financial situation thoroughly before committing additional resources towards unsecured lending options like personal loans, which may carry higher interest rates compared with secured alternatives such as mortgages.

What are the Implications of TDSR on Property Loans?

For those seeking property financing:

- The Total Debt Servicing Ratio directly influences mortgage approval processes; exceeding limits could lead banks or other lending institutions denying applications outright.

- Property buyers should consider existing liabilities carefully when assessing potential home purchases; ensuring they remain within safe boundaries helps mitigate risks associated with over-leverage.

How Can You Use TDSR to Your Advantage?

Understanding TDSR can help you make informed decisions about borrowing:

- It encourages financial discipline and prevents over-borrowing

- It helps you assess your borrowing capacity before applying for loans

- It motivates you to improve your financial health by increasing income or reducing debt

In conclusion, mastering the concept of TDSR is essential for anyone looking to borrow in Singapore. By understanding how it works and how to optimize your financial position, you can navigate the loan application process more effectively and increase your chances of approval.Key takeaways:

- TDSR limits total monthly debt obligations to 55% of gross monthly income

- It applies to most types of loans in Singapore

- Improving your TDSR can increase your borrowing capacity

- TDSR works alongside other metrics like MSR and LTV ratio

- Understanding TDSR helps you make informed borrowing decisions

Remember, responsible borrowing is key to maintaining financial health. Always assess your ability to repay before taking on any new debt obligations.

Conclusion: Key Takeaways on TDSR and Debt Management

Understanding Total Debt Servicing Ratios is essential for responsible borrowing practices in

Singapore’s competitive financial landscape:

- Maintain a healthy ratio below 55% by managing existing debts effectively. Be aware of how different loan types contribute to overall calculations, impacting future borrowing opportunities. Utilise strategies such as reducing liabilities or increasing incomes proactively

Improves overall financial health while minimising risks associated with excessive borrowing

commitments.

In Summary:

- The Total Debt Servicing Ratio (TDSR) helps regulate borrowing capacity based on individual

incomes relative to total outstanding debts. Understanding both its implications alongside

associated metrics like Loan-to-value ratios ensures informed decision-making throughout

various stages involving credit acquisition processes.

By following these principles diligently, individuals position themselves favourably within dynamic economic environments while pursuing long-term aspirations without compromising fiscal stability!

Here’s an extended FAQ for the Ultimate Loan Guide To Total Debt Servicing Ratio (TDSR) in Singapore:

Q: What is the Total Debt Servicing Ratio (TDSR) in Singapore?

A: The Total Debt Servicing Ratio (TDSR) is a framework introduced by the Monetary Authority of Singapore to ensure borrowers don’t over-extend themselves when taking on property loans. It limits the amount that individuals can borrow based on their total debt obligations and income. The TDSR applies to both residential and investment property loans in Singapore.

Q: How is the TDSR calculated?

A: The TDSR will be calculated based on the borrower’s total monthly debt obligations divided by their gross monthly income. The total debt obligations include all outstanding loans, including the new property loan being applied for. The TDSR must not exceed 55% of the borrower’s gross monthly income.

Q: What’s the difference between TDSR and MSR?

A: While both TDSR and MSR (Mortgage Servicing Ratio) are debt servicing frameworks, they apply to different scenarios. The TDSR applies to all property loans, including private properties and investment properties. The MSR, on the other hand, only applies to loans for HDB flats and executive condominiums. The MSR limits housing loan payments to 30% of a borrower’s gross monthly income.

Q: How does the TDSR affect my home loan application?

A: The TDSR limits the amount you can borrow for a property based on your income and existing debts. If your total debt obligations exceed 55% of your gross monthly income, you may need to reduce your loan amount, extend your loan tenure, or increase your down payment to meet the TDSR requirements.

Q: Are there any exemptions from the TDSR framework?

A: Yes, there are some situations where borrowers may be exempted from the TDSR framework. These include refinancing of owner-occupied properties, loans for owner-occupied properties that don’t exceed a certain Loan-to-Value ratio, and some specific scenarios involving investment properties. However, these exemptions are subject to certain conditions and may change over time.

Q: How does the TDSR affect interest rates for home loans?

A: While the TDSR doesn’t directly affect interest rates, it can influence the type of home loan you’re eligible for. If you’re close to the TDSR limit, you might have fewer options for loans, which could potentially impact the interest rate you’re offered. It’s always best to shop around and compare different bank loans to find the most competitive interest rate.

Q: Can I still get a loan if my TDSR exceeds 55%?

A: Generally, banks are required to maintain a TDSR of 55% or less for borrowers. However, in some cases, banks may have some flexibility for borrowers with high net worth or financial buffers. It’s best to consult with financial advisors or mortgage specialists to explore your options if your TDSR exceeds 55%.

Q: How can I improve my TDSR to qualify for a larger property loan?

A: To improve your TDSR and potentially qualify for a larger property loan, you can consider several strategies: increasing your income, reducing your existing debts, extending your loan tenure (which reduces monthly payments), or making a larger down payment. Remember, the goal is to ensure your total monthly debt obligations don’t exceed 55% of your gross monthly income.

Disclaimer: This information is provided for informational purposes only. PropsBit.com.sg does not endorse or guarantee its relevance or accuracy concerning your situation. While careful efforts have been taken to ensure the content’s correctness and reliability at the time of publication, it should not replace personalised advice from a qualified professional. We highly recommend against relying solely on this information for financial, investment, property, or legal decisions, and we accept no responsibility for choices made based on this content.