Singapore New Home Sale: Private Market Insights and Performance Analysis Report In March 2025

Introduction of Singapore New Home Sale

Singapore’s property market has proven to be a dynamic and highly competitive sector, drawing interest from both local buyers and international investors seeking stable and lucrative opportunities.

In this report captures the critical trends, performance metrics, and upcoming developments within the Singapore new home sales segment for March 2025.

By analyzing the latest data provided by the Urban Redevelopment Authority (URA) and OrangeTee & Tie Research & Analytics, we uncover key insights that highlight the state of the market and its appeal in uncertain economic landscapes.

Overview of Singapore New Home Sales Trends

Market Performance in March 2025

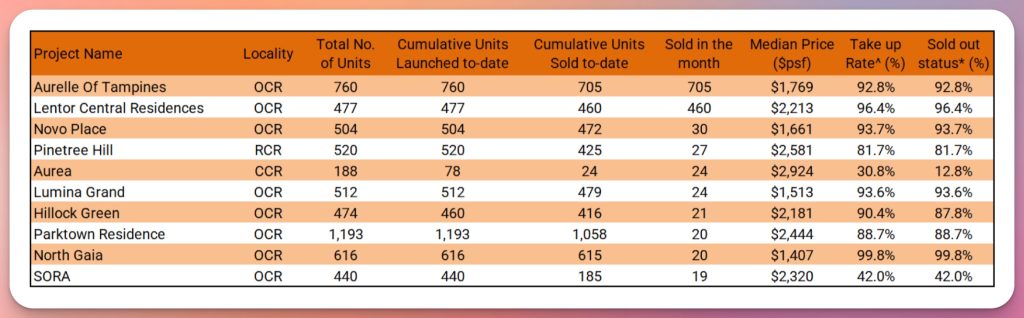

In March 2025, the Singapore new home sales market experienced significant movements, revealing both opportunities and challenges. According to the latest URA data:

- New home sales excluding executive condominiums (ECs): A total of 729 units were sold, marking a steep month-on-month drop of 54.4% from the 1,597 units transacted in February 2025.

- New home sales including ECs: Despite the overall slowdown, sales reached 1,510 units, demonstrating only a 7.1% decline compared to February’s 1,626 transactions.

Interestingly, when viewed through a year-on-year lens, new home sales excluding ECs showed a marginal growth of 1.5% compared to 718 units in March 2024. This signals resilience amid fluctuating buying sentiments and economic conditions.

Surge in Executive Condominium (EC) Transactions

While overall Singapore new home sales experienced a dip, the EC market surged remarkably, setting new records:

- 162 EC units crossed the S$2 million mark, a record-breaking feat compared to the previous high of 33 units sold in August 2023.

- By per-square-foot pricing, 751 EC units surpassed S1,500psf∗∗,with148unitspricedabove∗∗S1,800 psf.

The top-performing projects driving this trend include:

- Aurelle of Tampines: Accounting for 148 transactions above S$2 million.

- Lumina Grand: Responsible for 12 transactions.

- Altura: Contributing to 2 transactions.

These developments, particularly Aurelle of Tampines, underscore the robust demand for ECs positioned within well-connected locations and featuring attractive amenities.

Month-on-Month Decline in General Sales Volumes

The slowdown in Singapore new home sales for March 2025 was largely attributed to the reduced number of project launches. Comparing data:

- March 2025 launched homes (excluding ECs): Only 555 units were launched, a 67.2% decline compared to 1,694 units in February 2025.

- When ECs are included, March featured 1,315 launched units, reflecting a 22.4% decrease month-on-month.

This drop in new launches played a key role in moderating sales activity, as buyers possibly adopted a more cautious approach amid macroeconomic risks.

Key Drivers Behind Singapore New Home Sales Performance

Economic Context and Trade Uncertainties

The Singapore new home sale market operates within a highly trade-reliant economy, meaning macroeconomic factors have a significant impact on consumer confidence. Key concerns affecting the March 2025 sales include:

- U.S. tariffs on Singapore imports: Recently introduced tariffs have raised uncertainties for Singapore’s GDP growth trajectory.

- Potential trade tensions: These factors could lead cautious buyers to delay purchases in an unpredictable economic climate.

Despite these challenges, Singapore properties remain a prime example of stable investment assets, drawing interest from investors seeking long-term value.

High-Value Transactions in the Luxury Market

The luxury property segment remained relatively muted during March 2025, yet it showcased resilient demand for high-value units:

- One non-landed home above S10million:∗∗Soldfor∗∗S13 million, located at 32 Gilstead, with a size of 3,821 sqft.

- 11 non-landed homes priced between S5–10 million: This included four 1,798 sqft units at Aurea.

While overall luxury sales dipped, these transactions indicate sustained interest in Singapore’s premium residential properties, especially for international investors seeking exclusivity and robust returns.

Emerging Investment Appeals

Singapore properties, particularly within the Singapore new home sale category, continue to be seen as stable investment assets amid economic uncertainties. Buyers are drawn to:

- Long-term benefits of residential ownership.

- Resilience against market risks, bolstered by strong infrastructure and high-quality living standards.

Upcoming Developments to Drive Future Sales

Anticipated Launches in 2025

March 2025 was marked by reduced project launches; however, promising developments on the horizon are expected to rekindle buying activity in the following months. Notable upcoming projects include:

- One Marina Gardens: A 937-unit development launched in early April 2025, poised to attract buyers with its strategic location and integrated features.

- The Robertson Opus: Comprising 414 units, this project will cater to urban dwellers seeking convenient access to city amenities.

- Arina East Residences: With 107 units, this new launch targets niche buyers focused on exclusivity.

- The Sen @ De Souza Avenue: A 347-unit project, expected to appeal to families with its accessibility to schools and parks.

- Springleaf Residences: Featuring 941 units, this development emphasizes connectivity and serene living spaces.

These projects are set to reinvigorate demand, especially in March-April and beyond, reinforcing the market’s resilience against temporary fluctuations in sales activity.

Regional Market Segmentation

Outside Central Region (OCR)

The OCR remains a stronghold for Singapore new home sales, primarily fueled by competitive pricing and excellent connectivity. Buyers are increasingly targeting developments in regions like Tampines North and Lentor that combine affordability with proximity to emerging infrastructure such as:

- Tampines North MRT station.

- Lentor MRT station.

Rest of Central Region (RCR)

For buyers seeking a balance between accessibility and exclusivity, RCR projects have gained traction. Developments within this region include Aurelle of Tampines, which consistently attracts buyers with its proximity to parks, schools, and MRT stations.

Core Central Region (CCR)

The luxury market in CCR has been relatively subdued, with limited transactions observed in March 2025. However, CCR’s prime developments continue to appeal to affluent buyers looking for exclusivity and strong rental yield potentials.

Conclusion of Singapore New Home Sale

The Singapore new home sale market for March 2025 reflects both challenges and opportunities. While overall sales volumes have moderated compared to February 2025, specific segments such as executive condominiums have seen record-breaking performance.

Strategic developments, robust infrastructure, and Singapore’s investment appeal continue to position the property market as a reliable choice during periods of economic uncertainty.

Looking ahead, the anticipated launches of projects like One Marina Gardens, Springleaf Residences, and The Robertson Opus are expected to reinvigorate sales volumes and bring fresh energy to Singapore’s property landscape.

For investors and buyers, the continued highlights of stable long-term assets and high-quality developments make the Singapore real estate market a coveted arena in the region.

Through careful analysis and strategic planning, stakeholders can ensure sustained growth and tap into emerging opportunities, solidifying Singapore’s reputation as a global property hotspot.

Disclaimer: This information is provided for informational purposes only. PropsBit.com.sg does not endorse or guarantee its relevance or accuracy concerning your situation. While careful efforts have been taken to ensure the content’s correctness and reliability at the time of publication, it should not replace personalized advice from a qualified professional. We highly recommend against relying solely on this information for financial, investment, property, or legal decisions, and we accept no responsibility for choices made based on this content.