The Complete Guide of CCR, RCR and OCR in Singapore Property Regions: Your 2025 Investment Blueprint

When you’re looking to buy property in Singapore, understanding the island’s three main planning regions—Core Central Region (CCR), Outside Central Region (OCR), and Rest of Central Region (RCR)—can make the difference between a smart investment and an expensive mistake.

These designations, established by Singapore’s Urban Redevelopment Authority (URA), don’t just determine where you’ll live; they influence everything from property prices to rental yields, resale potential, and your daily lifestyle.

After analyzing thousands of property transactions and speaking with industry experts, I’ve compiled this comprehensive guide to help you navigate Singapore’s complex property landscape.

Whether you’re a first-time buyer, seasoned investor, or considering relocating to Singapore, this guide will give you the insights you need to make informed decisions.

Table of Content: The Complete Guide of CCR, RCR and OCR in Singapore Property Regions

What Are Singapore’s Property Planning Regions?

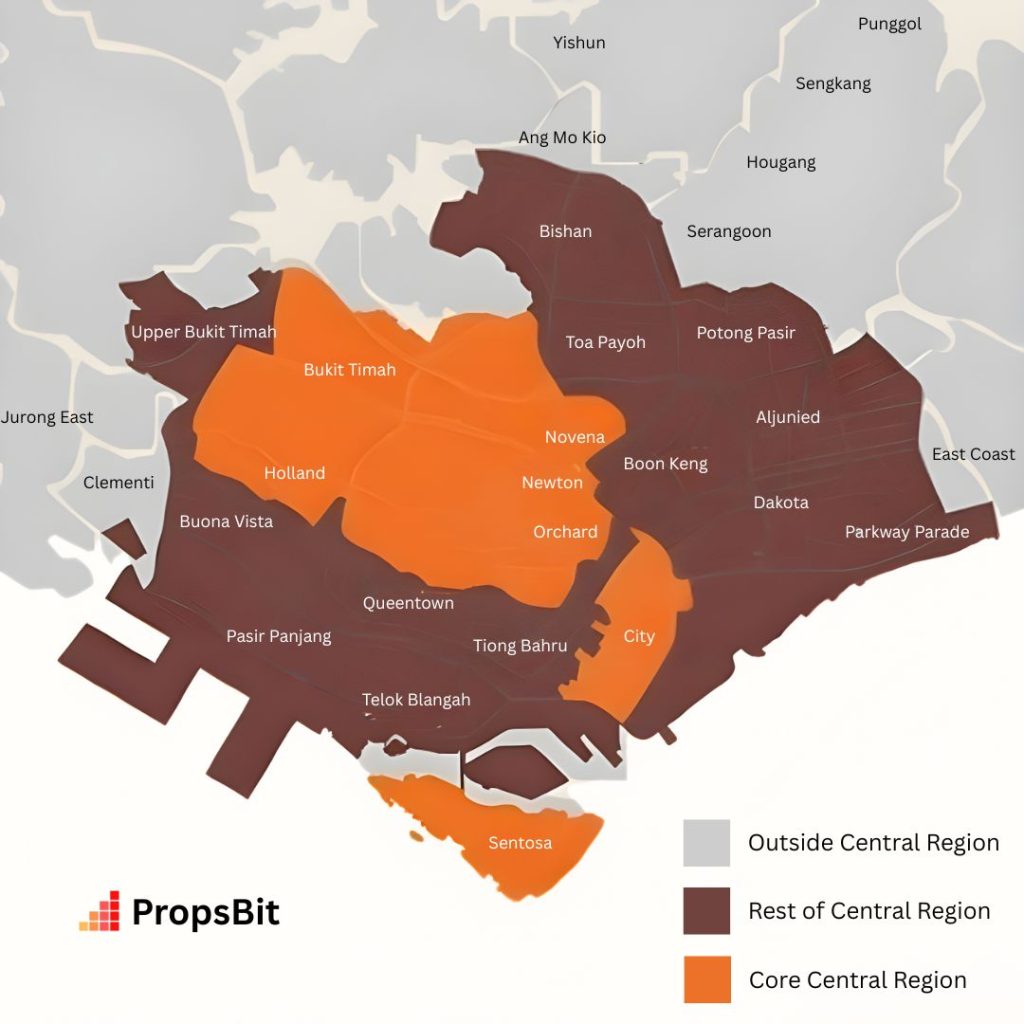

Singapore’s property market is divided into three distinct regions based on the URA’s Master Plan, each with unique characteristics, price points, and investment potential.

These regions were created to manage urban development systematically and ensure balanced growth across the island.

The Core Central Region (CCR) represents Singapore’s premium property belt, encompassing the central business district and most prestigious residential areas.

The Rest of Central Region (RCR) forms a buffer zone around the CCR, offering a balance between accessibility and affordability.

The Outside Central Region (OCR) covers the remaining areas, typically featuring newer developments and more family-friendly pricing.

Understanding these regions is crucial because they directly impact property cooling measures, Additional Buyer’s Stamp Duty (ABSD) rates, and loan-to-value ratios that the Singapore government uses to regulate the property market.

Core Central Region (CCR): Singapore’s Premium Property Hub

What Defines the CCR?

The Core Central Region encompasses Singapore’s most coveted postal districts: 1, 2, 6, 9, 10, and 11. This region includes the Central Business District (CBD), Orchard Road shopping belt, and historically significant areas like Chinatown and Little India.

Key CCR Districts Include:

- District 1: Boat Quay, Chinatown, Tanjong Pagar

- District 2: Anson Road, Tanjong Pagar, CBD

- District 6: City Hall, Clarke Quay, High Street

- District 9: Orchard Road, River Valley

- District 10: Ardmore, Bukit Timah, Holland Road

- District 11: Chancery Lane, Holland Road, Tanglin

Why CCR Properties Command Premium Prices

CCR properties consistently achieve the highest prices per square foot in Singapore, and there are compelling reasons beyond mere prestige. The region offers unparalleled connectivity to business hubs, with most locations within walking distance or a short MRT ride to major commercial centers.

Transportation Advantages: The CCR boasts Singapore’s densest MRT network, with multiple lines intersecting throughout the region. Residents typically enjoy access to at least two MRT lines within a 10-minute walk, providing seamless connectivity to every part of Singapore.

Lifestyle and Amenities: From world-class shopping at Orchard Road to fine dining establishments and cultural attractions, CCR residents have Singapore’s best amenities at their doorstep. The region houses prestigious schools, international hospitals, and recreational facilities that cater to expatriate and local elite populations.

CCR Investment Considerations

Price Range (2025):

- Condominiums: S$1,800 – S$4,500+ per square foot

- Landed properties: S$2,500 – S$8,000+ per square foot

CCR properties have historically shown strong capital appreciation, with average annual growth rates of 3-5% over the past decade. However, rental yields tend to be lower (2.5-3.5%) compared to other regions due to high purchase prices.

Who Should Consider CCR Properties:

- High-net-worth individuals seeking prestige addresses

- Expatriate executives prioritizing convenience

- Investors focusing on long-term capital appreciation

- Those requiring proximity to CBD for business

CCR Market Trends and Future Outlook

Recent data from URA shows CCR transaction volumes remained stable despite cooling measures, indicating strong underlying demand. The upcoming Thomson-East Coast Line completion will further enhance connectivity, particularly benefiting districts like Orchard and Marina Bay.

Emerging Hotspots in CCR:

- Marina Bay: With integrated resorts and upcoming Jurong Region Line

- Tanjong Pagar: Benefiting from Greater Southern Waterfront development plans

- Holland Village: Increasingly popular among young professionals and expatriates

Rest of Central Region (RCR): The Sweet Spot for Many Buyers

Understanding the RCR Landscape

The Rest of Central Region forms a strategic buffer around the CCR, encompassing postal districts 3, 4, 5, 7, 8, 12, 13, 14, 15, and 20. This region offers an attractive compromise between CCR prestige and OCR affordability, making it increasingly popular among both locals and expatriates.

Major RCR Districts:

- District 3: Alexandra, Commonwealth, Queenstown

- District 4: Harbourfront, Keppel, Sentosa

- District 5: Buona Vista, Dover, Pasir Panjang

- District 7: Beach Road, Bugis, Middle Road

- District 8: Farrer Park, Little India, Serangoon Road

- District 12: Balestier, Monovale, Toa Payoh

- District 13: Macpherson, Potong Pasir

- District 14: Geylang, Paya Lebar

- District 15: East Coast, Marine Parade, Siglap

- District 20: Ang Mo Kio, Bishan

Why RCR Offers the Best of Both Worlds

The RCR provides excellent value proposition for buyers seeking quality properties without CCR premium pricing. Many RCR locations offer comparable amenities and connectivity while maintaining more reasonable price points.

Connectivity and Transportation: Most RCR areas enjoy good MRT connectivity, with travel times to the CBD typically ranging from 20-35 minutes. The region benefits from both established lines and newer additions like the Circle Line and Downtown Line.

Lifestyle and Community: RCR areas often feature more spacious layouts and family-friendly environments compared to dense CCR locations. Many districts offer excellent local food scenes, community facilities, and recreational spaces while maintaining easy access to central Singapore.

RCR Investment Analysis

Price Range (2025):

- Condominiums: S$1,200 – S$2,200 per square foot

- Landed properties: S$1,400 – S$3,000 per square foot

RCR properties typically offer better rental yields (3.5-4.5%) compared to CCR, making them attractive for investors seeking regular income. Capital appreciation potential remains strong, particularly in well-connected areas with ongoing infrastructure development.

Strategic Investment Opportunities:

- Districts 3 & 5: Benefiting from One-North tech hub expansion

- District 15: East Coast’s lifestyle appeal and proximity to CBD

- District 12: Toa Payoh’s established amenities and central location

- District 14: Paya Lebar’s transformation into a regional hub

Emerging Trends in RCR

The RCR is experiencing significant transformation with government initiatives like the Paya Lebar Central development and the continued expansion of Jurong Innovation District.

These developments are attracting both multinational corporations and tech startups, driving demand for quality residential properties.

Future Growth Catalysts:

- Thomson-East Coast Line enhancing connectivity

- Smart Nation initiatives are creating tech job opportunities

- Urban redevelopment projects are improving infrastructure

- Growing expatriate population seeking value-conscious options

Outside Central Region (OCR): Singapore’s Growth Frontier

Defining the OCR Territory

The Outside Central Region encompasses all remaining postal districts not included in CCR or RCR, covering areas like Jurong, Tampines, Woodlands, and Punggol.

While traditionally considered suburban, many OCR areas have evolved into self-sufficient towns with excellent amenities and infrastructure.

Key OCR Growth Corridors:

- Western Region: Jurong, Clementi, Bukit Batok

- Northern Region: Woodlands, Sembawang, Yishun

- Eastern Region: Tampines, Pasir Ris, Changi

- North-Eastern Region: Punggol, Sengkang, Hougang

OCR’s Transformation and Modern Appeal

Gone are the days when OCR meant compromising on lifestyle or connectivity. Modern OCR townships feature comprehensive town centres, excellent schools, recreational facilities, and efficient public transportation networks.

Transportation Revolution: Recent MRT expansions have dramatically improved OCR connectivity. The Northeast Line, Circle Line, and upcoming Cross Island Line ensure most OCR residents can reach the city centre within 45-60 minutes.

Integrated Township Development: OCR areas showcase Singapore’s expertise in integrated urban planning. Towns like Punggol and Tampines feature everything from shopping malls and food courts to parks and sports facilities within walking distance of residential areas.

OCR Investment Opportunities

Price Range (2025):

- Condominiums: S$800 – S$1,400 per square foot

- Landed properties: S$900 – S$1,800 per square foot

OCR properties offer the best value for money in Singapore’s property market, with potential for both capital appreciation and rental returns. The region particularly appeals to young families, first-time buyers, and investors seeking higher rental yields.

Rental Yield Potential: OCR properties typically achieve rental yields of 4-6%, significantly higher than CCR and RCR options. This makes them attractive for investors prioritising cash flow over pure capital appreciation.

High-Growth OCR Hotspots

Punggol and Sengkang: These northeastern towns represent some of Singapore’s most successful new township developments. With young demographics, excellent schools, and comprehensive amenities, they’ve become highly sought-after among families.

Jurong and West Region: The government’s focus on developing Jurong as a second CBD has created significant investment opportunities. The upcoming Jurong Region Line and continued industrial development make this area particularly promising.

Eastern Corridor: Areas like Tampines and Pasir Ris benefit from proximity to Changi Airport and upcoming developments in the eastern region. These locations offer excellent value with strong growth potential.

Future OCR Developments

The OCR continues evolving with major infrastructure projects and township enhancements:

- Cross Island Line: Will connect the northeastern and western regions directly

- Jurong Region Line: Enhancing western region connectivity

- Punggol Digital District: Creating Singapore’s first smart district

- Tengah Town: Singapore’s first new HDB town in decades

Comparing the Three Regions: Making Your Decision

Price Comparison and Affordability

Understanding pricing differences across regions helps set realistic expectations and budget planning:

Average Condominium Prices (2025):

- CCR: S$2,500 – S$3,200 per square foot

- RCR: S$1,500 – S$1,800 per square foot

- OCR: S$1,000 – S$1,200 per square foot

Landed Property Comparison:

- CCR landed properties command a 2-3x premium over OCR equivalents

- RCR offers 30-40% savings compared to CCR with similar amenities

- OCR provides the best value for families seeking space and modern facilities

Rental Yield Analysis

Rental yields vary significantly across regions, influenced by purchase prices and rental demand:

Typical Rental Yields:

- CCR: 2.5-3.5% (lower yields due to high prices)

- RCR: 3.5-4.5% (balanced approach)

- OCR: 4-6% (highest yields, attractive for investors)

Transportation and Connectivity

Travel Time to CBD:

- CCR: 5-20 minutes

- RCR: 20-35 minutes

- OCR: 35-60 minutes

MRT Accessibility: All three regions now enjoy comprehensive MRT coverage, with OCR areas particularly benefiting from recent expansions.

Lifestyle and Amenities

CCR Lifestyle:

- Premium shopping and dining

- Cultural attractions and nightlife

- International schools and healthcare

- Compact living spaces

- Urban environment

RCR Lifestyle:

- Good balance of amenities and space

- Family-friendly environments

- Established neighborhoods

- Moderate commute times

- Mixed residential-commercial areas

OCR Lifestyle:

- Spacious living environments

- Modern integrated townships

- Excellent value for money

- Strong community feel

- Family-oriented facilities

Investment Strategies by Region

CCR Investment Approach

Best for:

- Long-term capital appreciation

- Prestige address requirements

- Expatriate rental market

- Luxury property portfolio

Key Considerations:

- Higher entry costs require significant capital

- Lower rental yields but strong appreciation potential

- Location within CCR matters significantly

- Government cooling measures impact more severely

RCR Investment Strategy

Optimal for:

- Balanced investment approach

- First-time serious investors

- Expatriate families seeking value

- Medium-term investment horizon

Strategic Advantages:

- Better rental yields than CCR

- Good capital appreciation potential

- More diverse property options

- Less volatile than the CCR market

OCR Investment Focus

Ideal for:

- Cash flow focused investors

- First-time buyers

- Young families

- Long-term wealth building

Growth Potential:

- Highest rental yields

- Strong infrastructure development

- The government focus on balanced development

- Emerging township transformation

Government Policies and Their Regional Impact

Additional Buyer’s Stamp Duty (ABSD)

Current ABSD rates affect all regions equally, but the absolute impact varies:

- Singapore Citizens: 0% for first property, 20% for second and subsequent

- Permanent Residents: 5% for first property, 25% for second and subsequent

- Foreigners: 60% across all categories

Total Debt Servicing Ratio (TDSR)

The 55% TDSR cap affects affordability across all regions but impacts buyers differently based on property prices and income levels.

Property Cooling Measures Timeline

Understanding policy cycles helps time property purchases effectively. Historically, cooling measures tighten during price run-ups and ease during market corrections.

Practical Tips for Property Buyers

Due Diligence Checklist

Research Requirements:

- Verify the exact postal district and planning region

- Check upcoming infrastructure developments

- Analyse historical price trends

- Understand rental market dynamics

- Consider the future supply pipeline

Financing Considerations

Loan Quantum by Region:

- All regions are subject to the same LTV limits

- Property value affects the loan quantum significantly

- Consider holding power for different price points

- Factor in the opportunity cost of capital

Professional Guidance

When to Engage Experts:

- Property agents specialising in target regions

- Financial advisors for investment structuring

- Legal counsel for complex transactions

- Tax advisors for investment implications

Market Outlook and Future Trends

Demographic Shifts

Singapore’s evolving demographics influence regional demand patterns:

- Ageing population: Increasing demand for accessible locations

- Young professionals: Preference for connectivity and lifestyle

- Expatriate communities: Balancing cost and convenience

- Investment migration: High-net-worth individuals seeking stable assets

Infrastructure Development Impact

Major Projects Affecting Regional Dynamics:

- Cross Island Line: Enhancing OCR connectivity

- Jurong Region Line: Transforming the western corridor

- Thomson-East Coast Line: Benefiting RCR areas

- Downtown Line extension: Connecting emerging districts

Technology and Smart City Initiatives

Singapore’s Smart Nation vision affects all regions through:

- Digital infrastructure improvements

- Smart mobility solutions

- Sustainable building requirements

- Tech hub development creating new demand centres

Climate Change and Sustainability

Future-Proofing Considerations:

- Green building standards affecting property values

- Climate resilience requirements

- Sustainable transportation options

- Energy efficiency impact on operating costs

Frequently Asked Questions

Q: Which region offers the best investment returns? A: Returns depend on investment strategy. CCR offers capital appreciation, RCR provides balance, while OCR delivers higher rental yields. Consider your investment timeline, risk tolerance, and cash flow requirements.

Q: How do cooling measures affect different regions? A: Cooling measures apply uniformly but impact regions differently due to buyer demographics. CCR faces more foreign buyer restrictions, while OCR attracts more local upgraders and investors.

Q: Should first-time buyers consider CCR properties? A: First-time buyers should carefully consider affordability and opportunity cost. RCR and OCR often provide better value for money and growth potential for initial property investments.

Q: How important is the exact postal district within each region? A: Very important. Districts within each region can have significantly different characteristics, prices, and growth potential. Research specific locations thoroughly rather than relying solely on regional classifications.

Q: What’s the minimum budget needed for each region? A: As of 2025, expect minimum budgets of S$800K-1M for OCR condos, S$1.2M-1.5M for RCR, and S$1.8M+ for CCR properties. Landed properties require significantly higher budgets.

Making Your Property Decision

Choosing between Singapore’s CCR, OCR, and RCR ultimately depends on your personal circumstances, investment goals, and lifestyle preferences. Each region offers distinct advantages, and the “best” choice varies by individual situation.

For Prestige and Convenience: CCR provides unmatched luxury and connectivity at premium prices.

For Balanced Value: RCR offers excellent compromise between location, amenities, and affordability.

For Growth and Yield: OCR delivers the best value proposition with strong future potential.

The Singapore property market continues evolving, with each region adapting to demographic shifts, infrastructure development, and government policies.

Success in property investment here requires understanding these regional dynamics, staying informed about policy changes, and aligning property choices with long-term financial goals.

Whether you’re buying your first home or expanding an investment portfolio, Singapore’s three-region system provides options for every budget and objective.

The key is thorough research, professional guidance, and realistic assessment of your needs and capabilities.

Sources and References:

- Urban Redevelopment Authority (URA) Master Plan and Property Data (URA)

- Ministry of National Development Housing Policies (MND)

- Monetary Authority of Singapore Financial Regulations (MAS)

- Singapore Exchange Property Market Reports (URA)

- Building and Construction Authority Green Building Guidelines (BCA)

- National Parks Board Singapore (NPark)

Disclaimer: The information provided here is for general guidance only. PropsBit.com.sg does not endorse or guarantee its suitability or accuracy for your specific situation. Although we strive to ensure the content is accurate and reliable at the time of publication, it should not substitute personalised advice from a qualified professional. We strongly recommend not relying solely on this information for financial, investment, property, or legal decisions, and we disclaim any responsibility for decisions made based on this content.

This website’s information is meant solely for general informational use. PropsBit.com.sg and its authors disclaim all liability and responsibility to any individuals or organisations for any outcomes resulting from the use of this website’s content or the information presented here. PropsBit.com.sg reserves the right to add, remove, or change the website’s content at any time without prior notice.