Explore the eligibility criteria and application process for the Enhanced CPF Housing Grant for families in Singapore. Understand how the HDB Flat Eligibility (HFE) Letter impacts your housing decisions.

Overview of the Enhanced CPF Housing Grant for Families

Understanding the Enhanced CPF Housing Grant for Families

The Enhanced CPF Housing Grant (EHG) for families is designed to assist Singaporean families in purchasing their own homes by providing financial support in the form of a grant.

Families qualify for the EHG by meeting several criteria, such as income ceilings, continuous employment, and property ownership conditions.

Families must have a core family nucleus, composed of core members such as applicants and occupiers, who will remain in the flat and physically occupy it during the minimum occupation period.

The grant amount depends on the average gross monthly household income over a 12-month period, ensuring lower-income households receive more.

Eligible family members will have their portion of the EHG credited to their CPF ordinary accounts, which they can then use to offset the purchase price or reduce the housing loan for their flat.

To successfully apply for this grant and understand the financing options, families are encouraged to obtain an HDB Flat Eligibility (HFE) Letter.

This letter informs families about their eligibility for purchasing a flat and the amount of CPF housing grants they qualify for, facilitating their flat buying journey.

Eligibility for CPF Housing Grants

Eligibility for CPF Housing Grants is centrally influenced by specific conditions that applicants must fulfill. These requirements are carefully structured to ensure that housing assistance is extended to those who genuinely need it and can maximize its benefits.

Firstly, the monthly household income plays a crucial role in determining eligibility. For instance, first-timer households planning to apply for the Enhanced CPF Housing Grant (EHG) need to ensure their average gross monthly household income does not exceed the set ceiling.

This income ceiling helps prioritise lower-income families, who will receive more substantial support. This aligns with the grant’s aim to promote affordable housing.

Applicants and their core members must demonstrate continuous employment to show a stable income before applying. This requirement ensures that there is a level of financial stability within the household, which is essential for sustaining home ownership.

The grant conditions also scrutinize the applicants’ property holdings. All applicants and occupiers must not own any private residential property locally or overseas, nor should they have disposed of any such property within the stipulated timeframe before the application.

This measure is in place to prevent grants from being used as a means to finance multiple property investments, which could drive up real estate prices and undermine the primary goal of providing affordable housing.

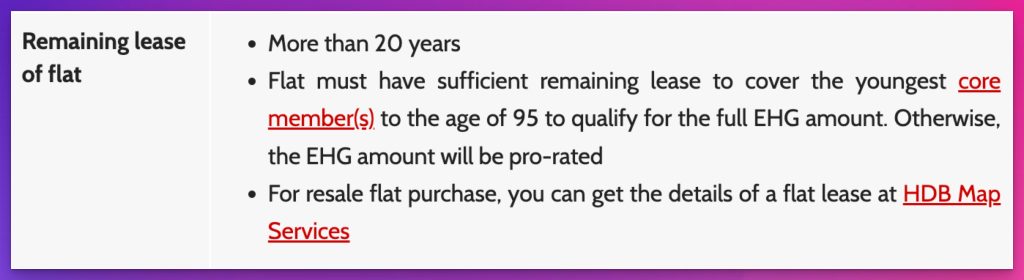

Finally, the remaining lease of the purchased flat is considered, with a mandate that it should have enough years left to cover the youngest core member until the age of 95 to qualify for the maximum grant amount.

Otherwise, the grant amount is adjusted proportionally according to the lease duration. Thus, by setting these comprehensive conditions, CPF Housing Grants work to ensure that government resources are allocated efficiently, benefitting families genuinely in need of financial assistance in purchasing homes.

Qualifying for the Enhanced CPF Housing Grant

To qualify for the Enhanced CPF Housing Grant (EHG), families must navigate a series of eligibility criteria that are structured to ensure that aid is provided to those with genuine housing needs.

Key among these criteria is the income threshold: potential recipients must ensure that their average gross monthly household income over the designated 12-month period does not surpass the specified ceiling.

This requirement is vital as it aligns with the grant’s mission to offer greater assistance to lower-income families, hence making home ownership more accessible. Furthermore, continuous employment is a crucial factor.

Applicants and their core members are required to exhibit a stable employment history, having worked continuously for at least 12 months leading up to the application, mirroring the need for sustained income that is vital for long-term homeownership.

In addition, property ownership is closely monitored. Neither applicants nor any occupiers should hold, or have recently disposed of, any local or overseas private residential properties.

This stipulation ensures that the grant supports families looking for a primary home rather than serving as a subsidy for multiple property investments.

Finally, the flat being considered must have sufficient remaining lease years to cover the youngest core member to the age of 95, to qualify for the full EHG amount, or otherwise, the grant amount will be proportionately adjusted.

These conditions collectively ensure that the EHG effectively supports those families most in need of housing assistance.

Proximity Housing Grant Eligibility

The Proximity Housing Grant (PHG) is an initiative designed to encourage families to live near each other, thereby fostering stronger family support networks.

To be eligible for the PHG, families must meet specific criteria, including the proximity condition, which mandates that the resale flat being purchased is located within 4 km of their parents’ or children’s home.

This grant aims to facilitate families in providing mutual support while also fostering closer familial ties.

Eligibility for the PHG also requires applicants to not have received the grant previously, ensuring that it is available to first-time beneficiaries.

In addition, the grant is open to both Singapore Citizens and Singapore Permanent Residents, provided they meet the residency requirements associated with the grant’s conditions.

Importantly, the PHG can be combined with other CPF housing grants, thereby offering increased financial flexibility for families committed to living nearby.

This combination of grants ultimately supports the overarching goal of maintaining strong community and family bonds while easing the financial burden associated with purchasing a home.

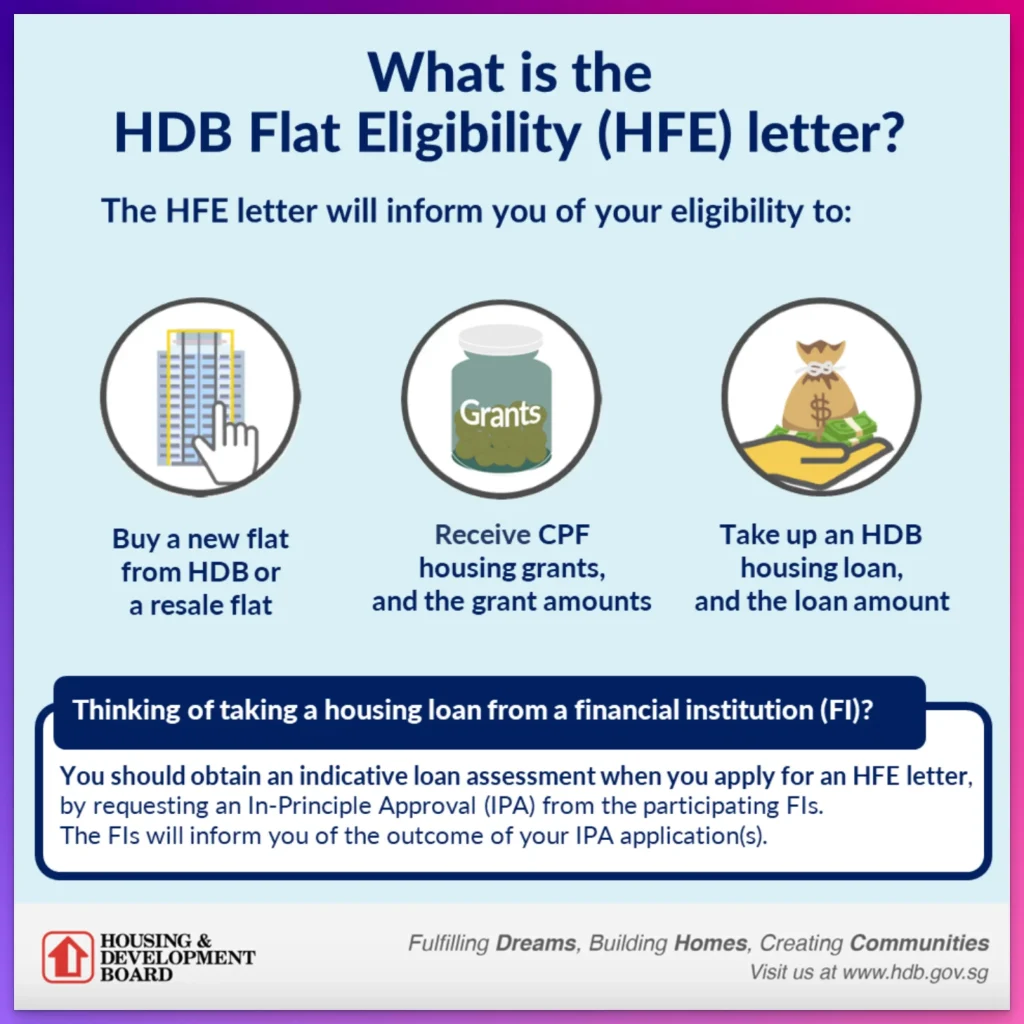

The HDB Flat Eligibility (HFE) Letter

The HDB Flat Eligibility (HFE) Letter serves as a crucial tool for families embarking on their home-buying journey in Singapore. This letter is a comprehensive document that provides potential applicants with detailed information about their eligibility for purchasing an HDB flat, whether new or resale, as well as the amount of CPF housing grants they may qualify for, including the Enhanced CPF Housing Grant (EHG).

The HFE Letter offers a holistic view of the applicant’s housing and financial standing, aiding in better planning and decision-making by outlining the types of financial assistance available and any restrictions based on income, previous property ownership, or employment status.

Families initiate the process of obtaining an HFE Letter by applying and providing details about their financial and employment status. This assessment considers the core family nucleus, which includes the main applicants and other occupants, ensuring all core members are accounted for in the eligibility evaluation.

The letter emphasises the requirement for applicants to remain in active employment and maintain a continuous employment history as a condition for eligibility, reflecting their financial stability and capability to sustain homeownership.

Importantly, the HFE Letter informs applicants about the required minimum occupation period (MOP) during which the flat must be occupied and lays out other stipulations, such as income ceilings and property ownership conditions, crucial for eligibility determination.

This thorough evaluation ensures that potential homeowners have a clear understanding of their housing options and financial commitments, providing confidence and clarity as they progress toward purchasing an HDB flat.

Purpose of the HFE Letter

The HFE Letter, or HDB Flat Eligibility Letter, plays a pivotal role in the home buying process for Singaporean families, serving as a strategic guide in understanding their eligibility for HDB flats, both new and resale.

It comprehensively outlines the household’s financial standing, determining how much CPF Housing Grant they might obtain, such as the Enhanced CPF Housing Grant (EHG) and other financial aids applicable.

By doing so, it acts as a cornerstone for families, enabling them to strategically plan their home acquisition by providing a detailed overview of their eligibility concerning income requirements, employment stability, and property ownership constraints.

This document is vital for ensuring that families are well-informed about their entitlements and the types of flats they can secure.

The HFE Letter makes it easier for applicants to comprehend the minimum occupation period requirements and ensures they adhere to the guidelines about living arrangements post-purchase.

Hence, the HFE Letter aids in navigating the nuanced landscape of property acquisition, enabling informed decisionsComprehensive Guide to Planning Your Flat Budget, and averting potential missteps in the complex process of buying an HDB flat.

This level of informed engagement is critical for supporting sustainable home ownership among Singaporean families.

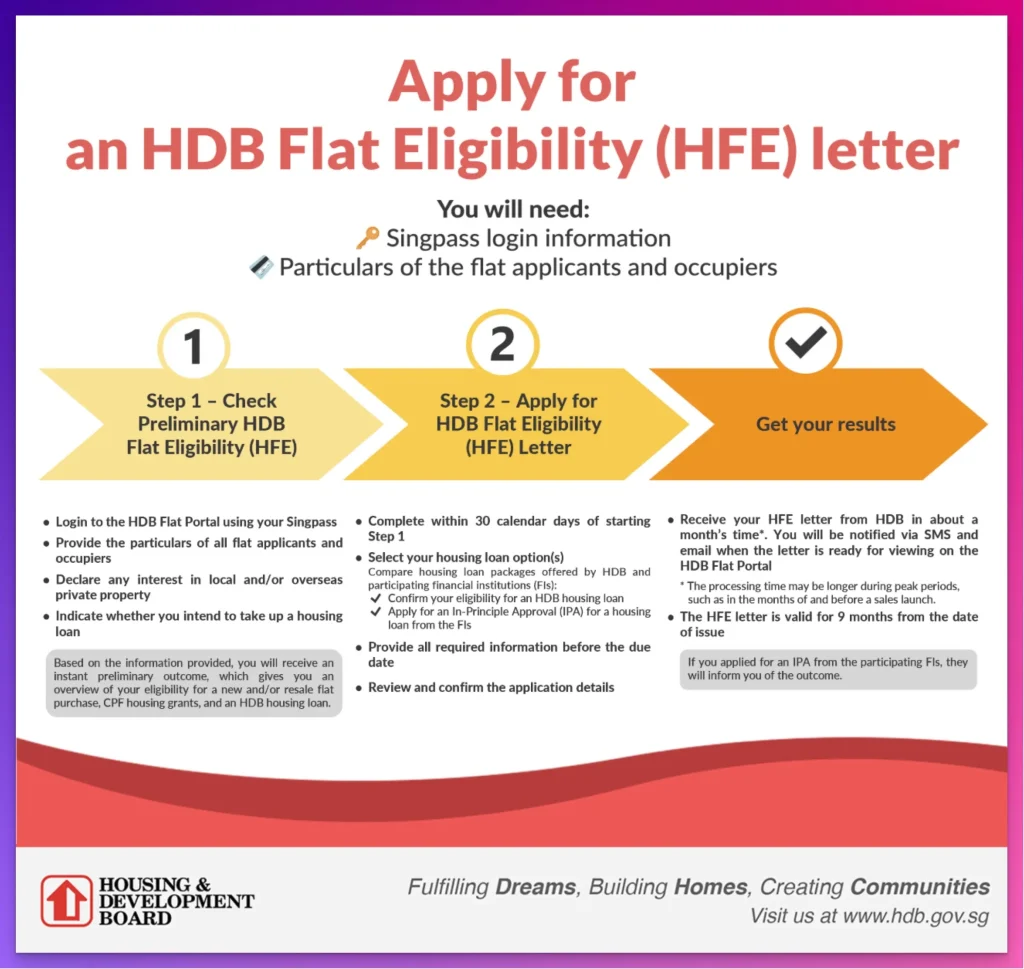

Application Process for the HFE Letter

The application process for obtaining an HDB Flat Eligibility (HFE) Letter is a critical step for families aspiring to purchase a flat in Singapore.

It begins with submitting an application via the official HDB Flat Portal, where applicants must provide comprehensive details about their financial and employment status.

This involves submitting documentation that verifies income, such as payslips, as well as proof of employment continuity.

The application includes details of all core family members, whose collective circumstances will be evaluated to determine eligibility for various CPF housing grants like the Enhanced CPF Housing Grant (EHG).

During the application process, it is essential for applicants to ensure that all stated financial details are accurate and up to date.

The HDB uses this information to assess the household’s overall eligibility to purchase a new or resale flat, taking into account income ceilings and property ownership status.

Applicants should also be prepared to demonstrate adherence to criteria such as continuous employment requirements and restrictions on existing property interests.

This ensures that the HFE Letter accurately reflects the household’s capabilities and aligns with the grant’s objectives of assisting those in genuine need.

Once approved, the HFE Letter serves as a definitive guide, facilitating informed decision-making and helping families plan effectively for their housing journey.

By following this well-structured process, applicants can ensure a smooth path to acquiring their desired home.

Core Family Nucleus and Eligibility

In the context of acquiring CPF housing grants, understanding the core family nucleus is an essential aspect of determining eligibility.

This term refers to the main group of individuals within a household—comprised of applicants and occupiers—whose collective presence and relationships fulfill the criteria necessary for purchasing an HDB flat.

Specifically, the core family nucleus typically includes married couples, parents with their children, multi-generational families, and orphaned siblings, each of whom must meet specific requirements to qualify for housing assistance.

This nucleus forms the foundation upon which eligibility for various housing grants, such as the Enhanced CPF Housing Grant (EHG), is evaluated.

Importantly, all members of the core family nucleus must maintain their status and physically occupy the flat during the Minimum Occupation Period (MOP), underscoring the importance of long-term commitment to the property.

This requirement ensures that government assistance is directed towards creating stable and enduring living arrangements.

Furthermore, eligibility assessments take into account the financial conditions of the entire nucleus, evaluating collective income levels and employment histories to confirm sustainable home ownership.

By defining and adhering to the guidelines concerning the core family nucleus, potential homeowners are positioned to leverage the full range of housing support available, emphasizing a structured and supportive path toward home ownership in Singapore.

Definition of Core Members

The concept of core members is pivotal in determining eligibility for CPF housing grants, especially in forming the core family nucleus required for purchasing an HDB flat.

Core members are defined as primary applicants and occupiers who constitute the household unit necessary to qualify under Singapore’s housing eligibility schemes.

This group includes married couples, parents and their children, immediate family members in multi-generation families, or orphaned siblings, who collectively must comply with various conditions related to the purchase of a flat.

Each core member plays a critical role in establishing the eligibility of the household for CPF housing grants. They are integral not only for meeting initial application requirements but also for fulfilling long-term occupancy conditions mandated by the housing authorities.

During the Minimum Occupation Period (MOP), all core members must physically occupy the property, reinforcing the grant’s objectives of fostering stable and sustainable home environments.

This ongoing presence ensures that the housing subsidies serve their intended purpose, enhancing community and familial stability over the long term.

The definition of core members also extends to their financial and employment status, which are crucial factors in grant eligibility assessments. All core members’ incomes and employment continuity records are considered to establish the household’s financial stability, thus aligning with the grant’s goal of aiding those in genuine need of housing support. Therefore, comprehending and appropriately configuring one’s core family nucleus is central to successfully navigating the housing grant application process, securing the necessary assistance to achieve sustainable home ownership in Singapore.

Minimum Occupation Period (MOP)

The Minimum Occupation Period (MOP) is a mandatory period during which homeowners are required to reside continuously in their HDB flat before they can sell or rent it out.

This period typically lasts for five years, during which all core members of the family nucleus, as specified in the HFE Letter, must physically occupy the flat.

The MOP is designed to ensure stability within the housing sector and promote community cohesion by encouraging residents to establish roots within their neighbourhoods.

The requirement is an essential consideration for prospective homeowners, particularly those applying for CPF housing grants such as the Enhanced CPF Housing Grant (EHG).

Failure to adhere to the MOP conditions could result in penalties or the forfeiture of any housing grants received. Therefore, understanding and planning for the MOP is crucial for families as they commit to owning their home.

It not only upholds the conditions of the grant but also supports the long-term goal of ensuring sustainable residency and integration within the community environment.

Income and Employment Criteria

The eligibility for CPF housing grants, including the Enhanced CPF Housing Grant (EHG), heavily depends on specific income and employment criteria. These criteria are meticulously structured to ensure that housing assistance is allocated to families who genuinely require it.

The foremost among these is the average gross monthly household income over a 12-month period, which must not exceed the prescribed ceiling.

This ceiling is tailored to ensure that lower-income families receive more substantial support, aligning with the grant’s mission to make housing more affordable and accessible to them.

Applicants and their core family members must also meet the continuous employment requirement. They need to have been engaged in stable employment for a minimum period before the application.

This requirement is crucial as it demonstrates a steady income stream, which is a vital indicator of financial stability necessary for sustaining home ownership.

Furthermore, the eligibility conditions meticulously examine the ownership of properties. Applicants must not own any private residential property, either locally or overseas, at the time of their grant application.

Additionally, they must not have disposed of any such properties within a specified period preceding their application to qualify for the grant.

This precaution ensures that the grants are not utilised for financing additional property investments, thereby maintaining their fundamental purpose of facilitating primary home ownership.

By setting these stringent yet necessary conditions, the CPF housing grants ensure that government resources are judiciously utilized to support families who are most in need of financial assistance.

This guarantees equitable access to affordable housing, helping lower-income families secure a stable and sustainable home environment.

Hence, understanding and fulfilling these income and employment criteria is paramount for applicants desiring to leverage the benefits of CPF housing grants effectively.

Monthly Household Income Ceiling

The monthly household income ceiling is a critical criterion in determining eligibility for the Enhanced CPF Housing Grant (EHG) and other CPF housing grants.

This ceiling sets a threshold for the average gross monthly household income over a 12-month assessment period, which applicants must not exceed to qualify for these grants.

It plays a pivotal role in ensuring that government assistance is specifically targeted towards families with genuine housing needs, primarily those belonging to the lower-income bracket.

By establishing this income limit, the EHG aims to provide more robust financial support to families that are less financially capable, thereby making home ownership more accessible and sustainable.

Understanding and adhering to this income ceiling is essential for applicants, as it directly impacts their eligibility and the level of assistance they receive, supporting the overarching goal of fostering affordable housing for families in need.

Continuous Employment Requirement

The continuous employment requirement is a fundamental eligibility criterion for applicants seeking the Enhanced CPF Housing Grant (EHG).

This stipulation ensures that potential homeowners possess a stable source of income, which reflects their financial stability and capacity to manage long-term homeownership obligations.

To fulfill this requirement, applicants and their core family members must have been employed continuously for at least 12 months prior to the HFE Letter application.

Additionally, they must remain employed at the time of application submission. This continuity in employment underscores the household’s economic resilience, ensuring that the grant is awarded to those genuinely able to sustain the financial demands of owning an HDB flat.

By adhering to the continuous employment requirement, families are more likely to maintain their homes successfully, aligning with the overarching goal of the CPF housing grants, which is to promote sustainable and affordable home ownership for Singaporean families.

Property and Ownership Considerations

A significant aspect of the eligibility criteria for CPF housing grants, including the Enhanced CPF Housing Grant (EHG), revolves around property ownership considerations.

The strict guidelines ensure that the support is directed towards those who have not already benefited from substantial property ownership, maintaining the primary objective of promoting affordable primary housing.

Applicants and occupiers must not own any private residential property, whether in Singapore or overseas. This includes any properties that have been acquired through purchase, gift, inheritance, or trust.

To qualify for the grant, these properties must not have been disposed of within a 30-month period prior to the HFE Letter application.

Additionally, the policy allows for limited ownership of non-residential properties, such as commercial or industrial premises, provided the household does not exceed ownership of one such property.

This provision ensures that while applicants may engage in business or investment activities, their primary housing needs are not secondary to their business interests.

The remaining lease of the flat they intend to buy is also scrutinised, needing to cover the youngest core family member until the age of 95 to receive the full grant amount. Otherwise, the grant is adjusted according to the lease duration.

These property and ownership considerations are essential measures to ensure that the CPF housing grants effectively serve families in need, focusing on providing opportunities for genuine home ownership in Singapore.

Ownership in Private and Non-Residential Properties

Ownership considerations are a crucial element of the eligibility criteria for CPF housing grants, including the Enhanced CPF Housing Grant (EHG).

To prevent misuse of grants and ensure they assist those genuinely in need, strict guidelines govern the ownership of both private and non-residential properties.

Applicants and occupiers must not own any private residential properties, whether within Singapore or overseas, at the time of application.

This includes properties acquired through means such as purchase, gift, inheritance, or trust arrangements, emphasising the focus on primary residential needs over investment activities.

Furthermore, any disposal of private residential property within 30 months before applying for the HFE Letter would disqualify the applicant from receiving the grant.

This clause is designed to avert attempts to use CPF housing grants to finance short-term investments or multiple property acquisitions, thereby securing the allocation of resources to first-time homeowners or those lacking substantial property holdings.

The policy also permits limited ownership of non-residential properties, allowing applicants to own one such property. This permits engagement in business activities without diverting the primary intention of the grants away from securing stable housing.

Thus, by establishing these restrictions, the CPF housing grants aim to fortify the prospects of home ownership for families with genuine housing needs, preserving the grants’ core mission of fostering affordable and accessible living options for Singaporean families.

Lease Requirements for HDB Resale Flats

When considering the purchase of a resale flat in conjunction with CPF housing grants such as the Enhanced CPF Housing Grant (EHG), it is essential to understand the lease requirements attached to this process.

A critical aspect of these requirements is ensuring that the remaining lease of the HDB resale flat is sufficient to meet certain criteria. Specifically, the flat must have enough years left on its lease to cover the youngest core family member until they reach the age of 95 to be eligible for the full EHG amount.

If the lease does not meet this requirement, the grant is proportionately reduced, aligning the financial assistance with the long-term viability of the housing purchase.

The lease duration is a significant consideration for potential flat buyers as it directly impacts the overall affordability and sustainability of their homeownership journey.

It ensures that families are investing in a property that not only serves immediate housing needs but also secures a stable living environment for the foreseeable future.

HDB provides resources, such as map services, to check the details of a flat’s lease, ensuring transparency and informed decision-making for prospective homeowners.

This requirement is integral to maintaining the focus of CPF housing grants on promoting enduring and meaningful homeownership for families in Singapore.

Distribution and Usage of the EHG

The Enhanced CPF Housing Grant (EHG) distribution is structured to effectively support eligible families in their homeownership journey.

Once a household is deemed eligible, the EHG is credited into the CPF Ordinary Accounts of the first-timer applicants within the core family nucleus. This allocation method ensures that the grant directly aids those purchasing the home.

The amount of EHG credited is based on the average gross monthly household income over the preceding 12-month period, with lower-income households receiving a larger grant amount in alignment with the grant’s mission to make housing more affordable for those in need.

The grant funds in the CPF Ordinary Accounts can be utilized to offset the purchase price of the HDB flat, thereby reducing the financial burden on families.

Additionally, these funds can be applied to decrease the housing loan requirement, making monthly loan repayments more manageable.

Occupiers who are part of the application but not the primary recipients of the EHG may also use their CPF savings, including any housing grants received, towards the flat purchase and for servicing the housing loan.

By enabling an effective allocation and practical use of the EHG, HDB aims to facilitate a smoother and more affordable transition to homeownership for eligible Singaporean families, ensuring long-term financial ease and housing stability.

How is the EHG Allocated?

The allocation of the Enhanced CPF Housing Grant (EHG) is meticulously designed to provide effective financial support to eligible families venturing into homeownership.

Once a family is approved for the EHG, the grant is credited directly into the CPF Ordinary Accounts of the first-timer applicants who form part of the core family nucleus.

The allocation hinges on the average gross monthly household income assessed over the past 12 months, with lower-income households receiving larger grants to better align with the grant’s objective of affording greater housing affordability to those in need.

These allocated funds can then be strategically used to offset the initial purchase price of an HDB flat, effectively reducing the financial strain that often accompanies home buying.

Additionally, the EHG can facilitate the reduction of the housing loan burden by decreasing the loan amount required, thereby making the repayments more manageable for the family over time.

Other members of the household, although not primary recipients of the EHG, can utilize their CPF savings, which include any received housing grants, towards purchasing the flat and settling the housing loan.

This structured allocation and utilization strategy ensures that the EHG serves its purpose of promoting affordable and sustainable homeownership for families across Singapore, providing foundational financial security for their housing journey.

Using the CPF Ordinary Account for Flat Purchases

In Singapore, the CPF Ordinary Account is a pivotal resource for prospective homeowners, enabling them to finance the purchase of their HDB flat effectively.

For families eligible for the Enhanced CPF Housing Grant (EHG), the grant amount is directly credited to their CPF Ordinary Accounts, bolstering their financial capacity to secure housing.

This mechanism ensures that the grant primarily aids in the reduction of the overall cost associated with purchasing a flat.

By utilising the funds in the CPF Ordinary Account, families can offset the purchase price, significantly reducing the immediate financial burden and ensuring a more manageable path to homeownership.

The CPF funds, including those from the EHG, can be directed towards both the initial flat purchase and servicing of any housing loan acquired. This flexibility provides families with a cushion to manage ongoing financial obligations while securing a stable living environment.

Moreover, the application of CPF savings in such a manner aligns with the overarching goal of the grant—to assist lower-income families in achieving sustainable homeownership.

This strategic use of the CPF Ordinary Account thus not only facilitates the immediate payment needs but also nurtures long-term financial stability for families navigating the complexities of housing acquisition in Singapore.

Next Steps in Your Flat Buying Journey

Navigating the path to purchasing an HDB flat involves several strategic steps that ensure you maximize the benefits of various CPF housing grants like the Enhanced CPF Housing Grant (EHG).

Firstly, prospective homeowners should engage in comprehensive financial planning and budgeting. Utilize available financial planning tools to assess your affordability and loan eligibility, which can aid in making informed decisions regarding your housing options.

It’s important to consider not only the upfront costs but also long-term financial commitments, such as loan repayments and maintenance fees for your flat.

Securing an HDB Flat Eligibility (HFE) Letter is a definitive step in this process. This document provides you with a clear understanding of your eligibility and potential benefit entitlements, such as CPF grants and loan amounts.

Completing this step with accurate and up-to-date information ensures a smoother home-buying experience by aligning your expectations with realistic outcomes.

After obtaining your HFE Letter, explore the various HDB flat types available, whether new BTO projects or existing resale flats, to find a property that fits not only your budget but also your lifestyle and locational preferences.

Lastly, align your purchase with the necessary regulations and requirements, such as occupation period mandates, to ensure compliance and retention of your CPF grants.

Every step taken in this journey should be strategically planned to facilitate a smooth transition into homeownership, leveraging the available CPF resources to secure a stable and sustainable living environment for your family in Singapore.

By carefully following these steps, you position yourself to make well-informed decisions that align with your long-term housing aspirations.

Financial Planning and Budgeting

Financial planning and budgeting are critical components in the journey towards homeownership, especially when considering the benefits of the Enhanced CPF Housing Grant (EHG) and other CPF schemes.

It is essential for potential homeowners to conduct a thorough assessment of their financial situation, identifying both immediate and long-term financial commitments associated with purchasing an HDB flat.

This includes evaluating upfront costs such as down payments, legal fees, and option fees, along with recurring expenses like loan repayments, insurance, and maintenance costs.

Utilizing financial planning tools can significantly aid in this process, offering insights into loan eligibility, monthly repayment schedules, and overall affordability.

These tools allow homeowners to set realistic financial goals and align their housing expectations with their financial capabilities. Additionally, understanding CPF contributions and the role of the CPF Ordinary Account in funding the flat purchase is essential for optimising available resources.

Budgeting effectively ensures that families are not only prepared for the initial purchase but are also equipped to handle future financial obligations without undue strain.

This proactive approach helps in making informed decisions about which grants to apply for, and which type of HDB flat to consider, ensuring that the choice aligns with the family’s financial landscape.

Ultimately, sound financial planning and budgeting pave the way for a sustainable and stress-free homeownership experience, allowing families to make the most of the opportunities provided by the CPF housing grants.

Finding and Purchasing a Flat

Finding and purchasing an HDB flat in Singapore can be a multi-faceted process, demanding careful planning and navigation through various eligibility requirements and housing options.

For first-timer applicants, a foundational step is understanding the types of flats available, such as Build-To-Order (BTO) units and resale flats, each offering distinct advantages that cater to different lifestyle preferences and financial considerations.

BTO flats, typically more affordable and customizable, require participation in application exercises, while resale flats provide immediacy and often locate in mature estates with established amenities.

Once identified, securing financing is crucial. The Enhanced CPF Housing Grant (EHG) and other available grants can significantly reduce financial burdens, contingent on meeting eligibility criteria like income ceilings and property ownership restrictions.

Acquiring an HDB Flat Eligibility (HFE) Letter early in the process is essential, as it provides clarity on eligibility status and grant amounts, guiding financial planning and budgeting efforts.

Engaging in the buying procedure for newly built flats involves navigating HDB’s application and balloting system, whereas purchasing resale flats requires understanding market valuations and negotiation strategies with sellers.

Throughout, it is vital to ensure compliance with all residency and Minimum Occupation Period (MOP) requirements to maintain grant benefits.

By leveraging financial tools and understanding the step-by-step buying processes, prospective homeowners can ensure a smooth transition to owning an HDB flat, sustainably anchoring them within the Singaporean housing landscape.Steps to Apply for the HDB Flat Eligibility Letter

Disclaimer: This information is provided for informational purposes only. PropsBit.com.sg does not endorse or guarantee its relevance or accuracy concerning your situation. While careful efforts have been taken to ensure the content’s correctness and reliability at the time of publication, it should not replace personalised advice from a qualified professional. We highly recommend against relying solely on this information for financial, investment, property, or legal decisions, and we accept no responsibility for choices made based on this content.