Challenges, Innovations, and Future Directions in Singapore Public Housing Exploration

In this blog, we dive deep into Singapore Public Housing, exploring its evolution, current challenges, and future possibilities. From the nostalgic memories of growing up in Marine Parade to the innovative technologies like 3D printing, we aim to address the complexities of homeownership and community living in Singapore.

Table of Contents of Challenges, Innovations, and Future Directions in Singapore Public Housing Exploration

- Introduction

- Why are BTOs more expensive today?

- New classification system for public housing

- Addressing the 99-year lease

- Are you worried about rising resale flat prices?

- Million-dollar HDB resale flats

- Behind HDB’s billion-dollar deficit

- PM Wong’s vision for housing in the future

- FAQ

Introduction

Singapore Public Housing has long been a cornerstone of our national identity. It transcends mere structures; it is about community, belonging, and shared experiences. The evolution of public housing reflects our journey as a nation, adapting to the needs of our citizens. From innovative construction methods to policies that ensure affordability, our approach to public housing is continuously evolving. Today, we’ll explore the future of housing in Singapore, the nostalgia of growing up in Marine Parade, and the balance between homeownership and investment.

Will we see 3D-printed flats in the future?

The future of housing construction in Singapore is indeed exciting. With advancements in technology, particularly 3D printing, we are on the brink of a revolution in how we build homes. Currently, HDB is harnessing the largest 3D printer in Southeast Asia, focusing on smaller components and furniture. While we may not be ready to construct entire flats just yet, the potential is immense.

As the technology matures, the possibility of 3D-printed flats is not far-fetched. Imagine a future where homes can be constructed in a matter of days, tailored to the specific needs of families. This innovation could drastically reduce construction time and costs, making homeownership even more accessible.

However, while we explore these futuristic avenues, it’s crucial to remember the core values of public housing: affordability and community. Any new technology must align with these principles to ensure we continue to serve the needs of our citizens effectively.

Memories of growing up in public housing in Marine Parade

Growing up in Marine Parade shaped my understanding of community and belonging. Nestled near East Coast Park, my childhood was filled with moments of joy—whether it was cycling to the beach or playing at the dragon playground with friends. These experiences created lasting memories that I cherish to this day.

The vibrant community spirit was palpable during block parties organized by the residents’ committee. Potluck gatherings, magic shows, and shared laughter fostered a sense of unity among neighbors. Such experiences are vital in shaping a community where individuals from diverse backgrounds come together.

Public housing isn’t just about providing shelter; it’s about creating spaces where relationships can flourish. It’s this blend of personal memories and communal experiences that makes Singapore Public Housing an integral part of our national narrative.

Homeownership VS speculative investment

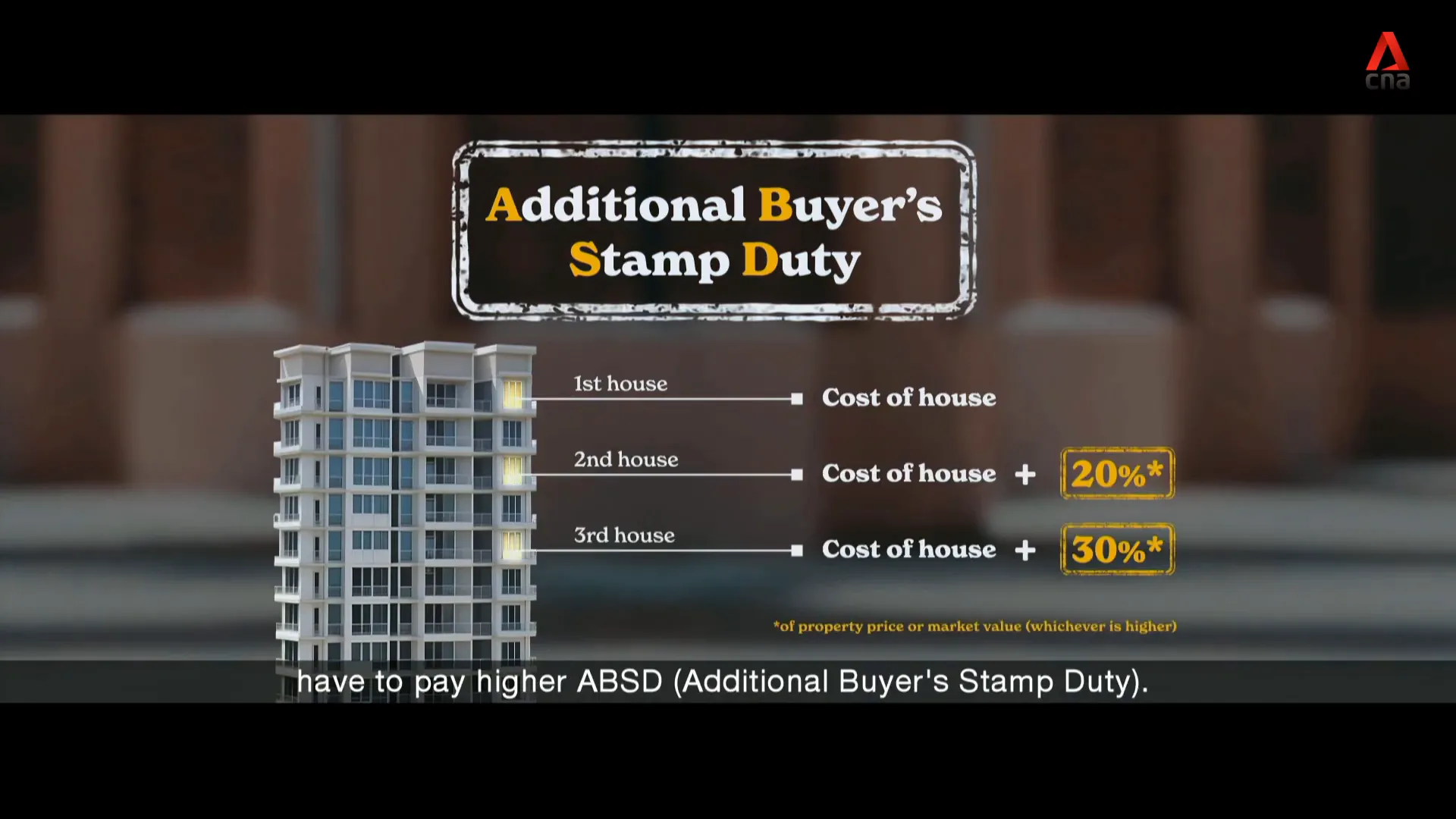

The concept of homeownership in Singapore is often intertwined with the notion of investment. While owning a home is a fundamental aspiration for many Singaporeans, it’s essential to distinguish between purchasing a home for living versus treating it as a speculative investment. The latter can lead to market volatility and create barriers for first-time buyers.

In recent years, we’ve seen shifts in the property market driven by speculation, causing concerns among prospective homeowners. The fear of missing out (FOMO) can lead individuals to make impulsive decisions, often resulting in financial strain. Policies must continuously adapt to mitigate these risks and ensure that housing remains a fundamental right rather than a speculative venture.

To address this, measures such as higher Additional Buyer’s Stamp Duty (ABSD) for multiple property purchases and tighter loan-to-valuation limits have been implemented. These policies aim to ensure that homeownership remains within reach for those who genuinely need it, rather than becoming a luxury for the few.

Furthermore, it’s vital to cultivate a culture that values homes as places of comfort and community rather than mere financial assets. As we navigate the complexities of the housing market, our focus must remain on ensuring that every Singaporean has the opportunity to own a home that serves as a foundation for their future.

Why are BTOs more expensive today?

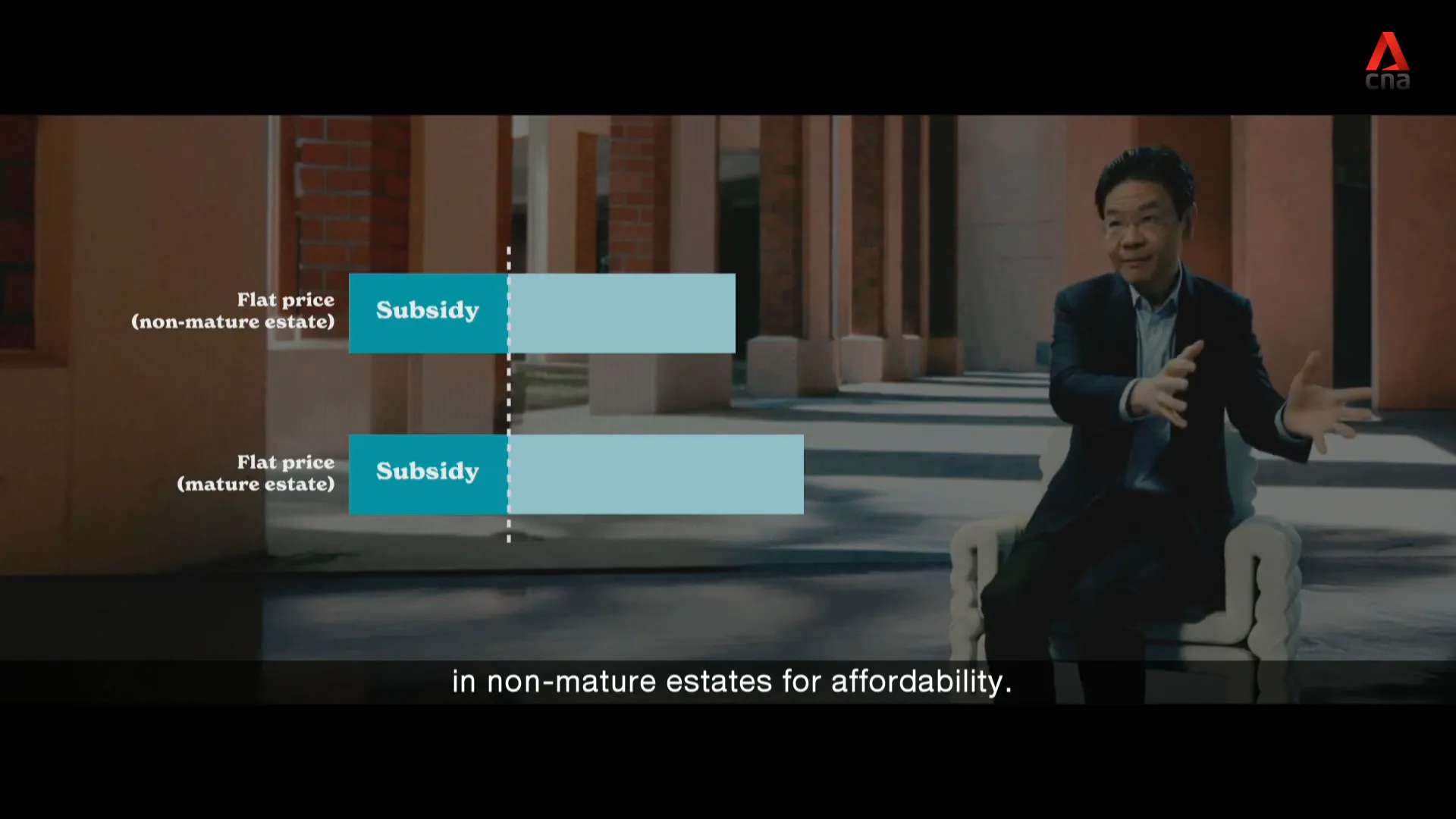

In recent years, the cost of Build-To-Order (BTO) flats has risen, prompting many Singaporeans to question the factors behind this trend. Several elements contribute to the increasing prices of BTOs, including demand, location, and market dynamics.

As Singapore continues to develop, the demand for housing remains robust. More young couples are entering the market, seeking their first homes, which naturally drives prices up. Additionally, the growing urbanization has led to a scarcity of land, especially in desirable areas, further inflating costs.

Moreover, the classification of public housing has evolved. HDB flats in mature estates—those with better amenities and transportation links—tend to command higher prices. While the government provides subsidies, the price difference between mature and non-mature estates can be significant.

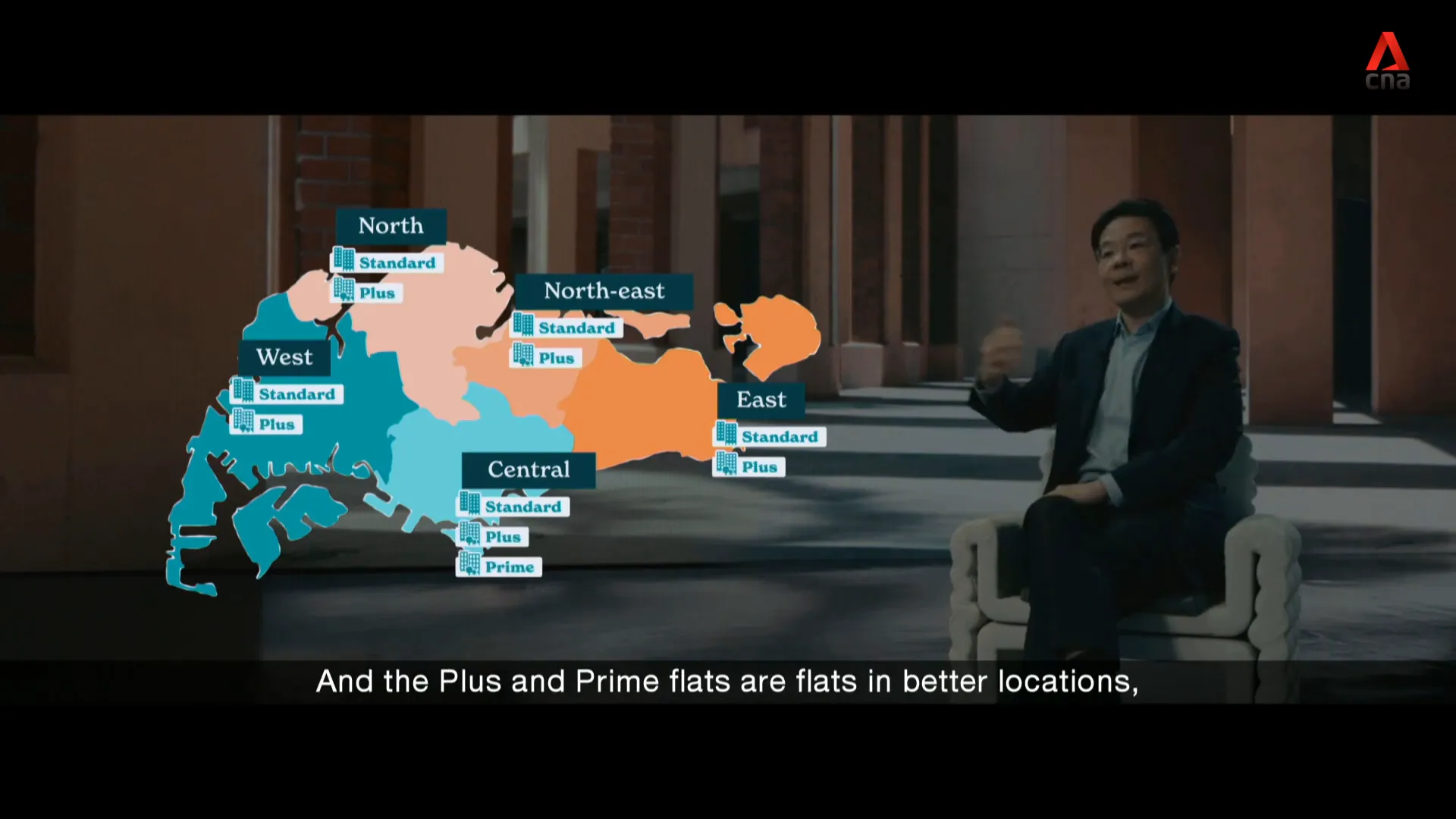

New classification system for public housing

To address concerns about affordability and fairness, a new classification system for public housing has been introduced. This system categorizes flats into three distinct groups: standard, plus, and prime flats. The aim is to create a more structured approach to pricing and subsidies.

Standard flats are akin to the traditional non-mature estate offerings, while plus and prime flats are positioned in more attractive locations. The pricing for these flats reflects their desirability, which is why they come at a higher cost. However, the government is committed to ensuring that subsidies are adjusted accordingly to maintain affordability.

Plus and prime flats will have additional restrictions when it comes to resale, requiring that any subsidies received be returned to HDB upon sale. This ensures that the benefits of government support remain within the public housing system, allowing future generations the same opportunities.

Addressing the 99-year lease

The 99-year lease system for HDB flats often raises concerns among potential buyers. However, it is essential to understand that this model is not unique to public housing; it is also prevalent in the private property market. Ownership rights remain intact during the lease period, allowing homeowners to sell or sublet their flats.

Engagement and education are crucial in addressing misconceptions about the lease system. Many Singaporeans recognize that a 99-year lease provides ample time to build equity and value in their homes. By the time they reach retirement, homeowners can unlock significant value from their flats.

Moreover, the government’s commitment to maintaining affordable housing hinges on this lease structure. Transitioning all land to freehold would risk making housing unattainable for future generations, as the benefits would disproportionately favor current landowners. The 99-year model allows for a fair distribution of housing resources across generations.

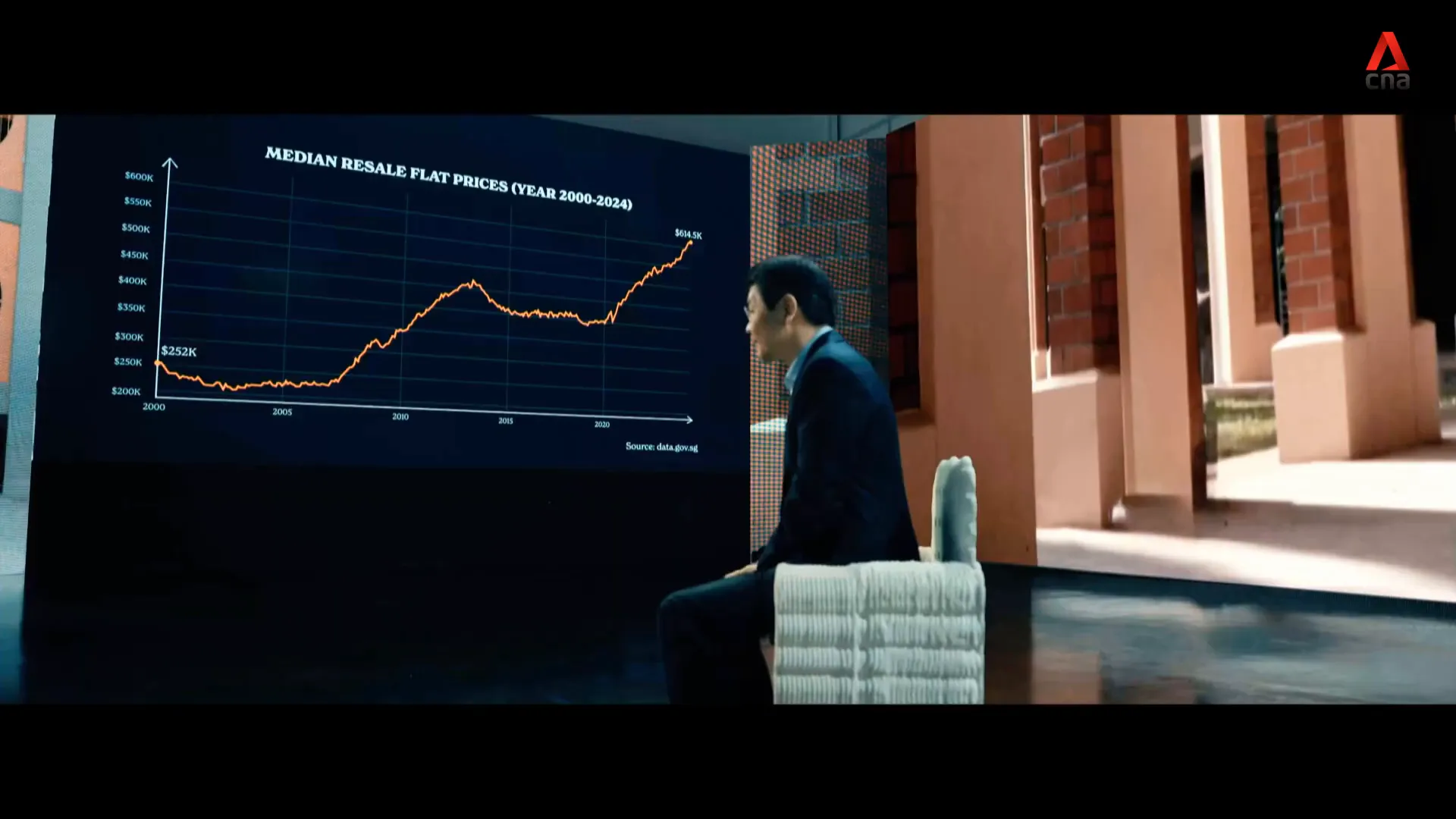

Are you worried about rising resale flat prices?

Rising resale flat prices can indeed be a concern for many Singaporeans, especially first-time buyers. However, it is important to contextualize these price changes within the broader economic landscape. Resale prices for HDB flats have generally moved in line with incomes, which suggests that the market remains accessible for most buyers.

Additionally, the government has implemented various measures to stabilize the market. By increasing the supply of both HDB and private flats, the intention is to moderate price increases and ensure that housing remains within reach for Singaporeans.

First-time buyers benefit from grants and other support mechanisms, which help ease the financial burden of purchasing their first home. The government’s ongoing commitment to affordability means that even in a rising market, there are pathways available for individuals to secure their own homes.

Million-dollar HDB resale flats

The phenomenon of million-dollar HDB resale flats has become increasingly common, capturing the attention of many Singaporeans. These flats, often located in desirable areas, showcase the evolving perceptions of public housing.

As demand for housing in prime locations continues to grow, the resale prices of HDB flats have surged. Factors such as limited supply, location attractiveness, and the overall economic landscape contribute to this trend. While these prices may seem staggering, they reflect a broader narrative about housing value in Singapore.

It’s essential to contextualize these high prices within the framework of rising incomes. Many Singaporeans are now able to afford these flats, thanks in part to government initiatives and grants that assist first-time buyers. The reality is that despite the million-dollar tags, many are still able to navigate the market successfully.

Understanding the dynamics

The dynamics of the housing market are complex. Million-dollar resale flats often come with several amenities and advantages, including proximity to schools, public transport, and vibrant community spaces. These factors elevate their desirability, leading to higher demand and, consequently, higher prices.

Moreover, the emotional aspect of homeownership plays a significant role. For many, owning a flat in a sought-after area represents not just a financial investment but a personal achievement. This emotional connection can drive buyers to pay a premium, further inflating the market.

However, it’s crucial for potential buyers to remain informed and cautious. The allure of high-value properties can lead to impulsive decisions. Understanding the long-term implications of such investments is vital to ensure financial stability.

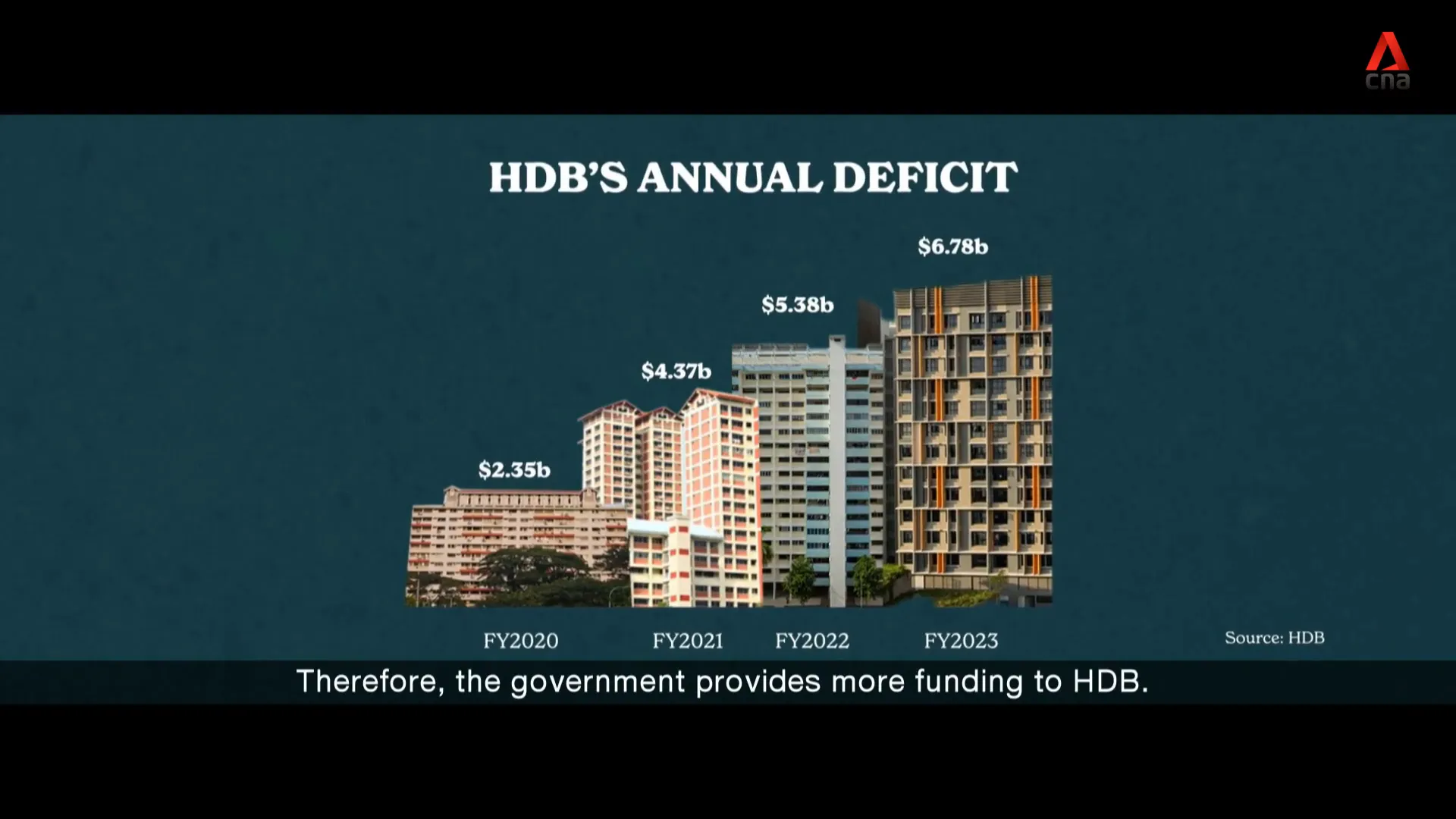

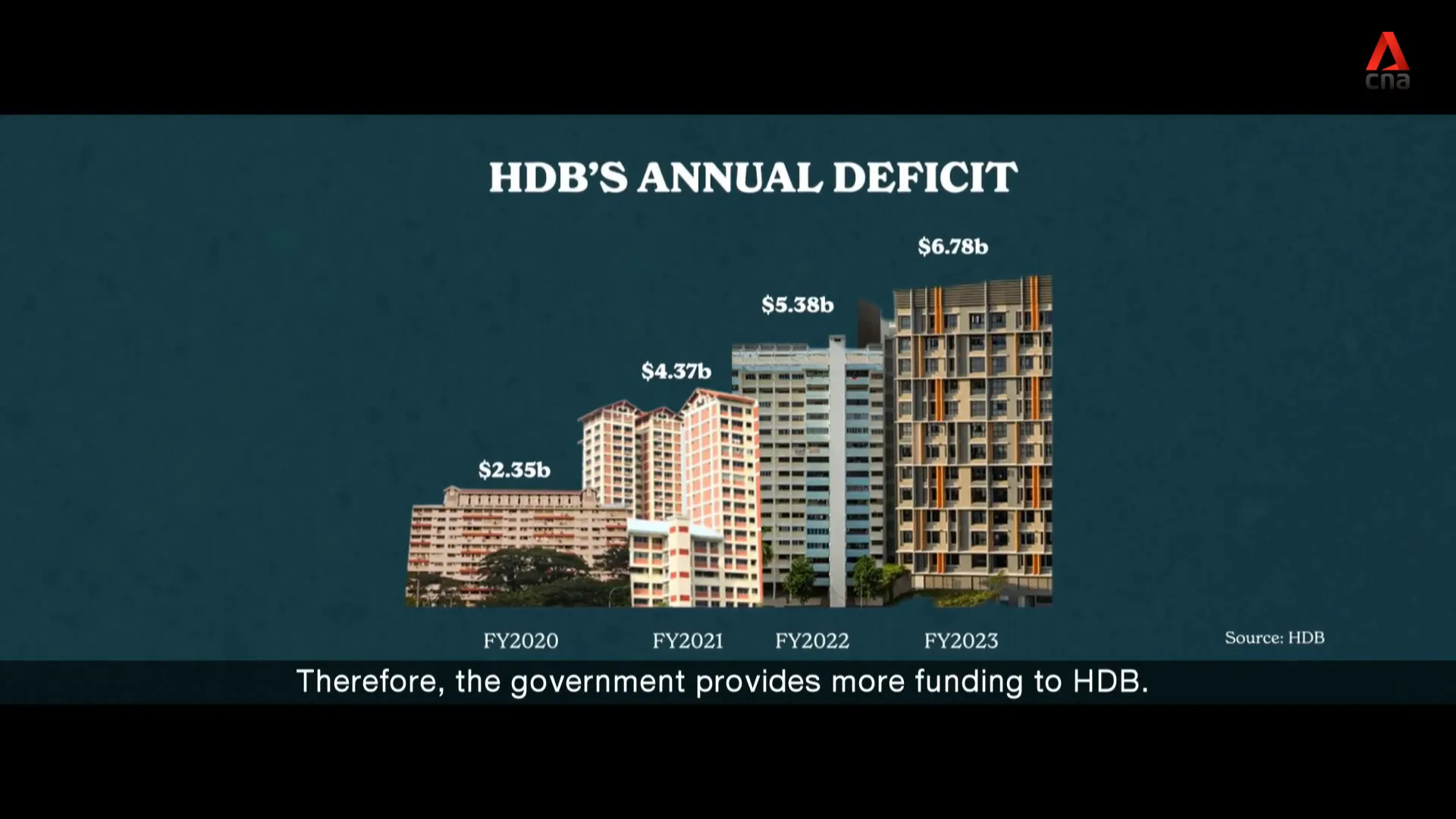

Behind HDB’s billion-dollar deficit

The billion-dollar deficit faced by HDB is a pressing issue that requires attention. This deficit arises primarily because HDB sells flats to Singaporeans at prices below their actual market value. The government subsidizes these costs to ensure affordability, but this practice inevitably leads to a financial shortfall.

While the intent behind this model is to provide affordable housing, it also poses challenges for HDB’s fiscal sustainability. As the demand for housing continues to rise, so does the pressure to maintain affordability while managing operational costs.

Understanding this deficit is crucial. It highlights the government’s commitment to ensuring that housing remains accessible for all Singaporeans, even in the face of rising market prices. This approach, however, does require continuous evaluation and adjustment to ensure that HDB can sustain its mission.

Implications for future housing policies

The billion-dollar deficit illustrates the need for a balanced approach to housing policy. As we look to the future, it’s vital to explore innovative solutions that can alleviate this financial burden while still providing affordable housing options.

This may include revising subsidy structures, exploring alternative funding sources, or enhancing partnerships with private developers. The aim should be to create a sustainable housing ecosystem that meets the needs of Singaporeans without compromising on quality or affordability.

PM Wong’s vision for housing in the future

PM Wong’s vision for the future of housing in Singapore emphasizes three core principles: affordability, community, and fairness. These guiding tenets are essential in shaping a housing landscape that is inclusive and accessible for all.

First and foremost, maintaining affordability is paramount. The government is committed to ensuring that every generation of Singaporeans has the opportunity to own a home. This commitment will involve continuous adjustments to policies and subsidies, ensuring that they remain relevant to the evolving needs of the population.

Secondly, fostering a sense of community is vital. Housing estates should not merely be places to live but vibrant communities where individuals from diverse backgrounds come together. This sense of belonging is integral to the Singaporean identity and social fabric.

Ensuring fairness in the system

Lastly, fairness must be a cornerstone of housing policy. It’s crucial that all Singaporeans feel they have an equal opportunity to benefit from public housing initiatives. The government is aware of the disparities in housing access and is actively working to address these issues.

As we look ahead, PM Wong’s vision will guide the development of policies that not only respond to current challenges but also anticipate future needs. This proactive approach is vital for creating a resilient housing system that can withstand economic fluctuations and demographic changes.

FAQ of Challenges, Innovations, and Future Directions in Singapore Public Housing Exploration

What are the main factors driving the prices of BTO flats?

The prices of Build-To-Order (BTO) flats are influenced by various factors including demand, location, and government policy. As urbanization continues and more young couples enter the market, demand naturally rises, leading to increased prices.

How does the government support first-time buyers?

The government offers various grants and subsidies to assist first-time buyers in purchasing their flats. These initiatives aim to reduce the financial burden and make homeownership more attainable.

What is HDB’s approach to managing rising resale prices?

HDB continuously reviews its pricing strategies and adjusts policies to stabilize the market. This includes increasing supply and introducing measures to ensure that housing remains affordable for all Singaporeans.

Are there plans to increase the supply of HDB flats?

Yes, the government is actively working to ramp up the supply of HDB flats to meet the growing demand. This includes launching more BTO projects and exploring innovative construction methods to expedite the building process.

Disclaimer: This information is provided for informational purposes only. PropsBit.com.sg does not endorse or guarantee its relevance or accuracy concerning your situation. While careful efforts have been taken to ensure the content’s correctness and reliability at the time of publication, it should not replace personalized advice from a qualified professional. We highly recommend against relying solely on this information for financial, investment, property, or legal decisions, and we accept no responsibility for choices made based on this content.