Is My HDB Flat Affordable? Unpacking Singapore’s Public Housing Market

As Singapore’s public housing prices continue to rise, the question of affordability looms large. In this blog, we delve into the intricacies of how BTO flats are valued, the teams behind HDB pricing, and the broader implications for potential homeowners. Join us as we explore whether HDB flats remain within reach for Singaporeans.

Table of Contents of Is My HDB Flat Affordable?

- Public Housing Affordability Called Into Question

- How BTO Flats Are Valued

- Valuation and Pricing Teams in HDB

- How BTO Flat Prices Have Increased

- Is Housing Still Affordable?

- How HDB Measures Affordability

- Rising Resale Flat Prices

- How Do Resale Prices Affect BTO Flat Prices?

- Buffering New Buyers from Paying Full Market Values

- Understanding the Impact of Inflation on Affordability

- The Role of the Central Provident Fund (CPF)

- The Subjective Nature of Affordability

- Government Subsidies and Their Implications

- The Balance Between Public Housing and Other Services

- Frequently Asked Questions

Public Housing Affordability Called Into Question

In recent years, the affordability of Singapore’s public housing has sparked significant debate. Since around 2011, concerns about rising housing prices have taken center stage in public discussions. Annual price increases have led many to question whether HDB flats remain accessible to the average Singaporean. If these flats were genuinely affordable, the perception would likely be different. However, as prices climb, so too does the anxiety of potential homeowners.

This ongoing discourse has permeated various parliamentary sessions, with the government emphasizing its commitment to maintaining affordability. Yet, the question persists: if HDB flats are truly affordable, why do so many Singaporeans express concerns? The essence of this issue lies in understanding the factors influencing public housing pricing and accessibility.

How BTO Flats Are Valued

Understanding how BTO (Built-To-Order) flats are valued is crucial for grasping their pricing structure. The Housing and Development Board (HDB) employs a combination of methods to determine the market value of these properties. Valuation involves assessing various factors, such as the flat’s location, size, and proximity to amenities. For instance, a site near an MRT station or a shopping mall typically commands a higher market value.

Each BTO project undergoes a thorough evaluation process. The valuation team conducts site inspections and analyzes comparable properties to establish a fair market value. This process is akin to what is seen in the private sector, where market dynamics play a significant role. However, the valuation does not solely dictate the final price of the flat.

Valuation and Pricing Teams in HDB

The teams responsible for valuation and pricing at HDB work hand in hand to ensure that flats remain affordable. The valuation team assesses the market value, while the pricing team determines the final selling price based on that valuation. This collaboration is vital, as it helps balance the need for affordability with the realities of market conditions.

Disagreements occasionally arise between the valuation and pricing teams regarding the extent of price adjustments. Each team brings its perspective to the table, with the valuation team aiming to justify their assessments and the pricing team focusing on ensuring affordability. This dynamic reflects the delicate balance that HDB must maintain between market realities and the needs of prospective homeowners.

How BTO Flat Prices Have Increased

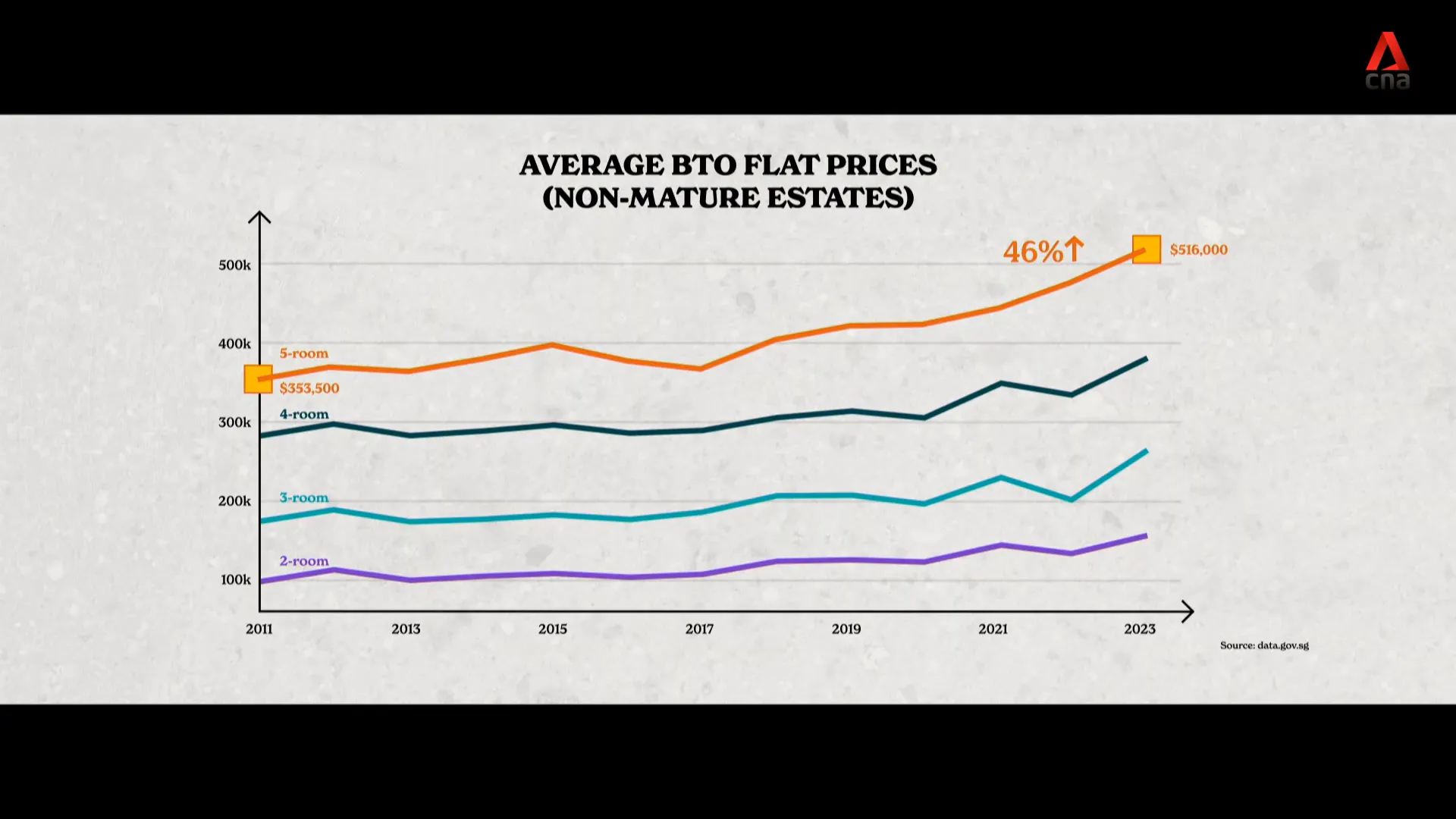

Since 2011, the average prices of BTO flats have seen a noticeable rise. In non-mature estates, which are characterized by fewer amenities, prices have steadily climbed for various flat types. For example, five-room flats have experienced price increases exceeding 46%. This trend raises the question: are these flats still affordable for the average Singaporean household?

The average selling prices of BTO flats, particularly in non-mature estates, have consistently outpaced the growth of median household incomes. While the government emphasizes that affordability remains a priority, the rising prices have led many to feel priced out of the market. The perception of affordability is further complicated by the types of flats that new applicants aspire to own, often gravitating towards larger units.

Is Housing Still Affordable?

The question of whether housing in Singapore is still affordable cannot be answered with a simple yes or no. While the government claims that BTO flats remain accessible, many potential homeowners feel otherwise. A critical factor in this discussion is the relationship between housing prices and household incomes. Interestingly, median incomes have risen slightly faster than housing prices, suggesting that BTO flats might still be within reach for some.

However, the aspirations of new applicants play a significant role in shaping perceptions of affordability. Many first-time buyers now aim for larger flats, which can yield greater profits in the resale market. This shift in mindset, combined with rising living costs and inflation, contributes to the belief that HDB flats are becoming less affordable.

How HDB Measures Affordability

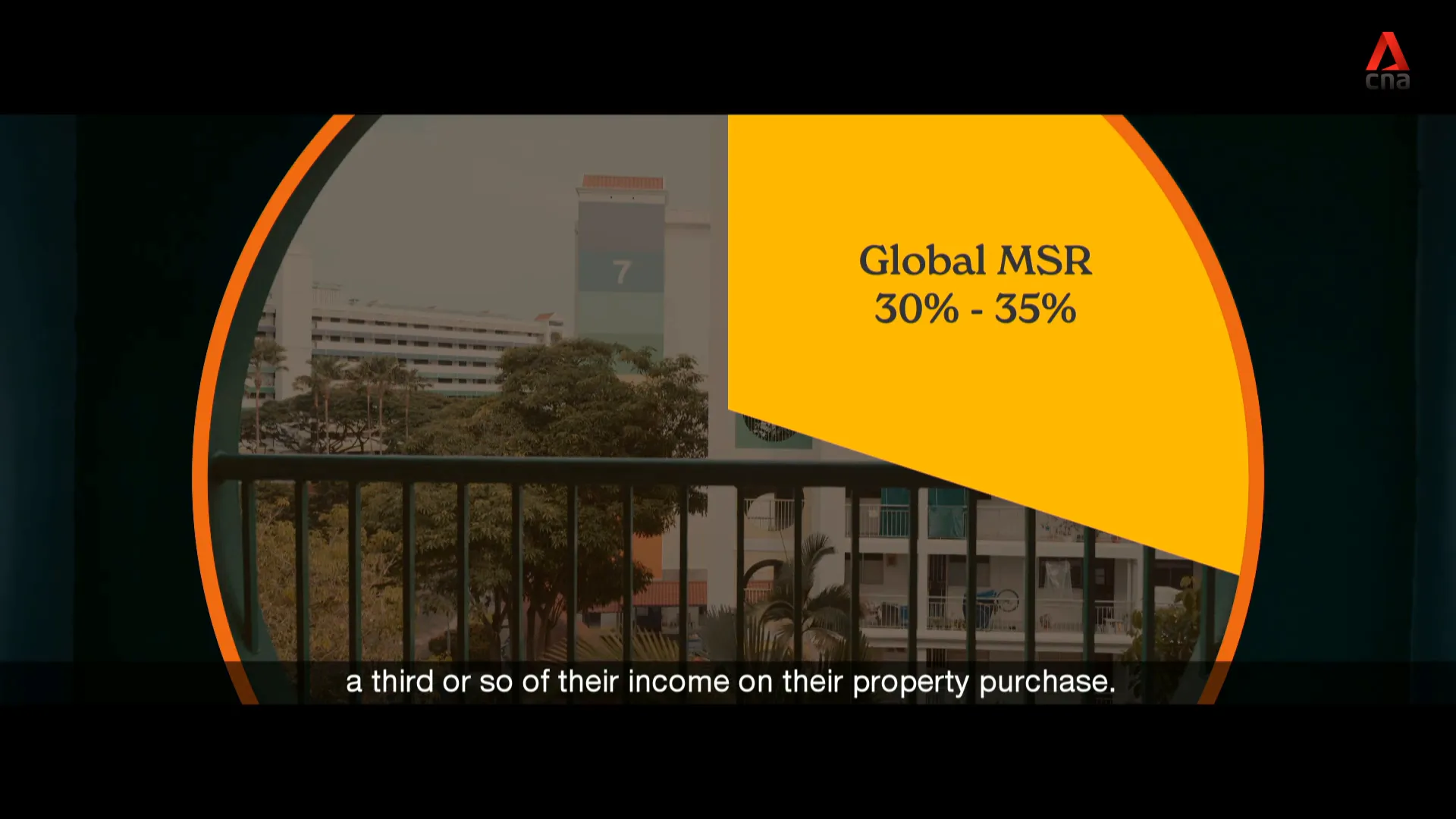

Affordability in the context of HDB flats is gauged through several key indicators. One of the primary metrics is the Mortgage Servicing Ratio (MSR), which reflects the proportion of a household’s income allocated to monthly mortgage payments. A globally accepted benchmark suggests this ratio should ideally be between 30% to 35% of a household’s income.

In 2023, approximately 90% of new flat buyers reported an MSR of 25% or less. This statistic indicates a significant level of affordability, ensuring that most households can comfortably manage their mortgage payments without financial strain.

Rising Resale Flat Prices

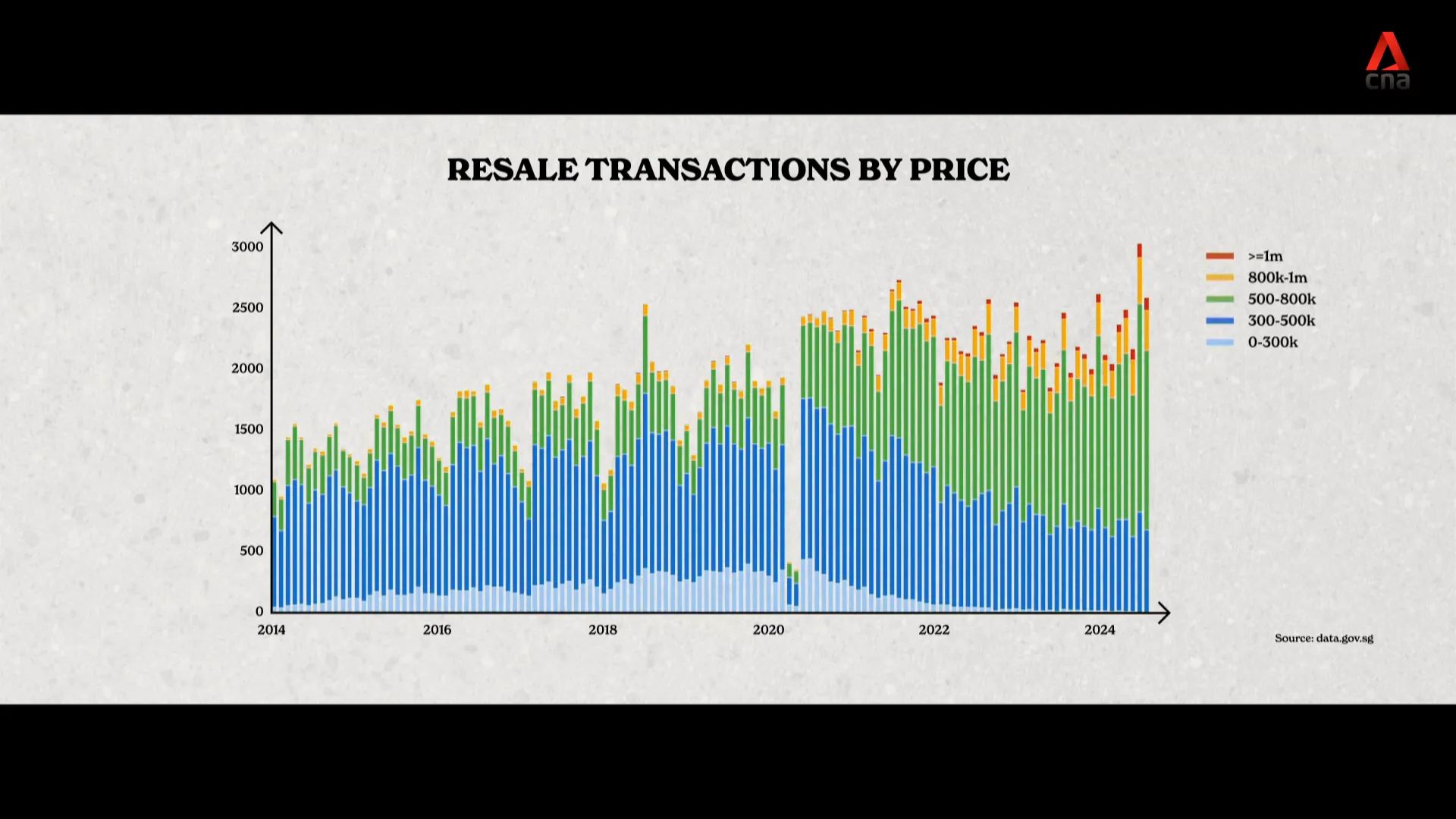

In recent years, the resale market has shown a dramatic increase in prices, with many flats now exceeding half a million dollars. The number of million-dollar transactions has surged, climbing from just 12 in 2015 to 1,035 in 2024. This uptick has raised concerns among potential buyers who feel priced out of the market.

For example, in August 2022, five-room flats in popular areas like Ang Mo Kio approached prices typically associated with private condominiums. This trend not only affects first-time buyers but also creates a ripple effect, influencing perceptions about the affordability of new BTO flats.

How Do Resale Prices Affect BTO Flat Prices?

The relationship between resale prices and BTO flat prices is complex. While the government aims to decouple these two markets, they remain interconnected. Rising resale prices often lead to higher assessments for BTO flats, as location value plays a significant role in pricing.

Previously, BTO prices were directly linked to resale prices. However, the current strategy involves applying market discounts to ensure that new flats remain affordable. These discounts can range from 20% to 35%, providing a cushion for new buyers against the full market value.

Other Related Articles:

Buffering New Buyers from Paying Full Market Values

One of the key strategies employed by HDB to maintain affordability is the application of market discounts. These discounts are designed to shield new buyers from the full brunt of rising market values. By offering subsidies and linking prices to household incomes, HDB ensures that first-time buyers are not overwhelmed by escalating costs.

For instance, a household with an average income can expect to pay no more than 25% of their income on a new home. This approach aims to balance the scales, making homeownership attainable even as market prices rise.

Understanding the Impact of Inflation on Affordability

Inflation is another factor influencing perceptions of affordability. As the cost of living increases, many households find themselves with less disposable income for leisure and other expenses after paying their housing mortgage. This can create a sense of financial strain, even if housing prices remain relatively stable compared to income growth.

While median household incomes have risen slightly faster than housing prices, the overall inflationary environment can overshadow these positive trends. Thus, the subjective notion of affordability is shaped not just by prices but also by the broader economic landscape.

The Role of the Central Provident Fund (CPF)

The Central Provident Fund (CPF) plays a crucial role in housing affordability in Singapore. As a mandatory savings scheme, CPF allows citizens to set aside a portion of their income for retirement, healthcare, and housing. This system provides a unique avenue for home financing that many countries lack.

With CPF, homeowners can use their accumulated savings to pay for their home loans, reducing the burden of monthly mortgage payments. For many, this means that the effective out-of-pocket expenses for purchasing a home become significantly lower, enabling more families to consider BTO flats as a viable option.

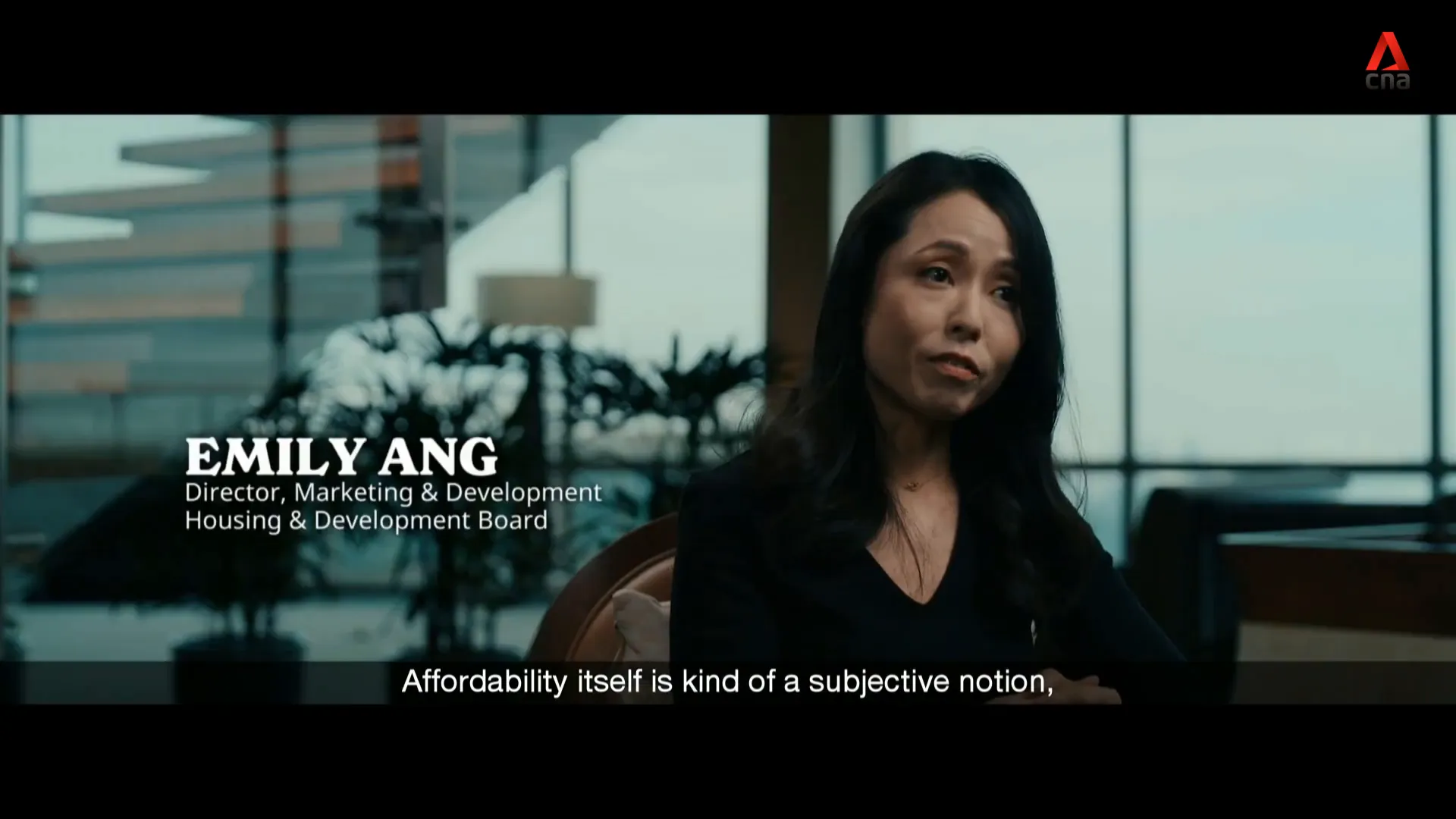

The Subjective Nature of Affordability

Affordability is inherently subjective, influenced by personal circumstances, aspirations, and societal norms. While objective measures such as price-to-income ratios exist, individual perceptions can vary widely. For some, a BTO flat might be affordable based on their income, while for others, the same flat could feel out of reach.

In recent years, we’ve seen a shift in the types of flats that young buyers aspire to own. Where three-room flats were once the norm, many first-time applicants now aim for larger, more expensive options. This change in aspiration can skew the perception of affordability, leading to increased dissatisfaction among those who feel priced out.

Government Subsidies and Their Implications

Government subsidies are vital in keeping HDB flats accessible to Singaporeans. These subsidies help to offset the costs associated with purchasing a home, allowing families to buy flats at prices that reflect their income levels rather than just market values. This financial assistance is particularly important for first-time buyers, who may face significant hurdles in securing a home.

However, the implications of these subsidies are twofold. While they make homeownership more attainable, they also contribute to the rising costs of public housing. As subsidies increase, so too does the financial burden on the government, leading to potential trade-offs with other public services like healthcare and education.

The Balance Between Public Housing and Other Services

Balancing the need for affordable public housing with other essential services is a complex challenge. The government’s commitment to maintaining affordability comes with a cost. HDB’s annual deficit highlights the financial pressures resulting from efforts to subsidize housing while also ensuring quality public services.

When more funds are allocated to housing, it can mean less availability for critical areas like healthcare and education. Thus, the government must carefully consider how to distribute resources to meet the diverse needs of the population. This balancing act is vital to ensuring that all Singaporeans can benefit from quality public services while also having access to affordable housing options.

Frequently Asked Questions

Is my HDB flat affordable?

Affordability can vary based on individual financial situations, aspirations, and market conditions. It’s essential to assess your income, savings, and financial commitments to determine if a flat is within your reach.

What role does CPF play in home ownership?

The CPF provides a savings mechanism that allows homeowners to finance their homes using their accumulated savings, significantly reducing out-of-pocket expenses for monthly mortgage payments.

How do government subsidies affect pricing?

Subsidies help to lower the effective purchase price of HDB flats, making them more accessible. However, they also contribute to the overall financial burden on the government, which must balance housing costs with other public services.

Why are larger flats becoming more desirable?

In recent years, many first-time buyers have shifted their preferences towards larger flats, viewing them as better long-term investments. This trend can skew perceptions of affordability, as larger flats typically come with higher price tags.

What factors influence the perceived affordability of public housing?

Factors such as household income, market conditions, personal aspirations, and broader economic trends all play a role in shaping perceptions of affordability in public housing.

Disclaimer: This information is provided for informational purposes only. PropsBit.com.sg does not endorse or guarantee its relevance or accuracy concerning your specific situation. While careful efforts have been taken to ensure the content’s correctness and reliability at the time of publication, it should not replace personalised advice from a qualified professional. We highly recommend against relying solely on this information for financial, investment, property, or legal decisions, and we accept no responsibility for choices made based on this content.