Singapore Rental Market Rebounding: Key Insights from Q1 2025

Table of Content: Singapore Rental Market 2025

Private and HDB Rental Markets See Rising Volumes in Early 2025

Singapore’s rental landscape has shown promising signs of recovery in the first quarter of 2025, with both private and HDB rental markets experiencing increased demand following the festive period.

Transaction volumes have rebounded significantly, marking a positive shift after the traditional year-end slowdown. This comprehensive analysis examines the latest trends, regional price movements, and future projections for Singapore’s dynamic rental market.

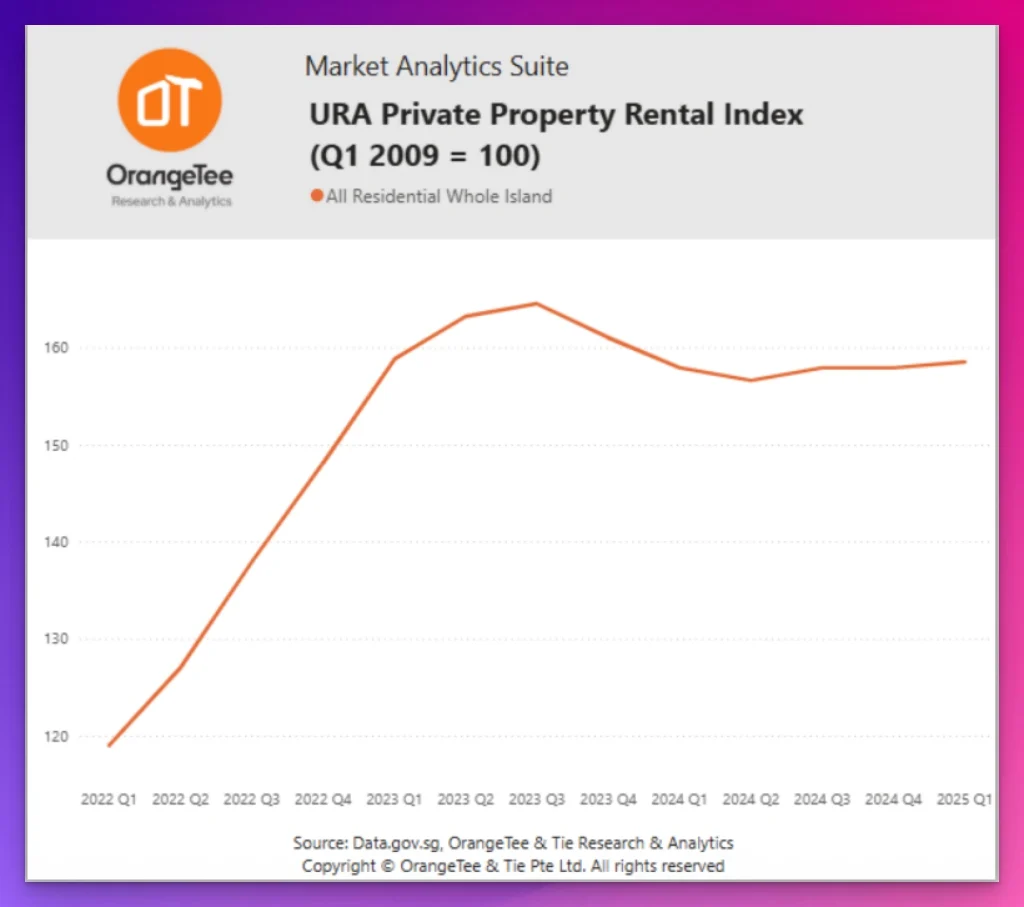

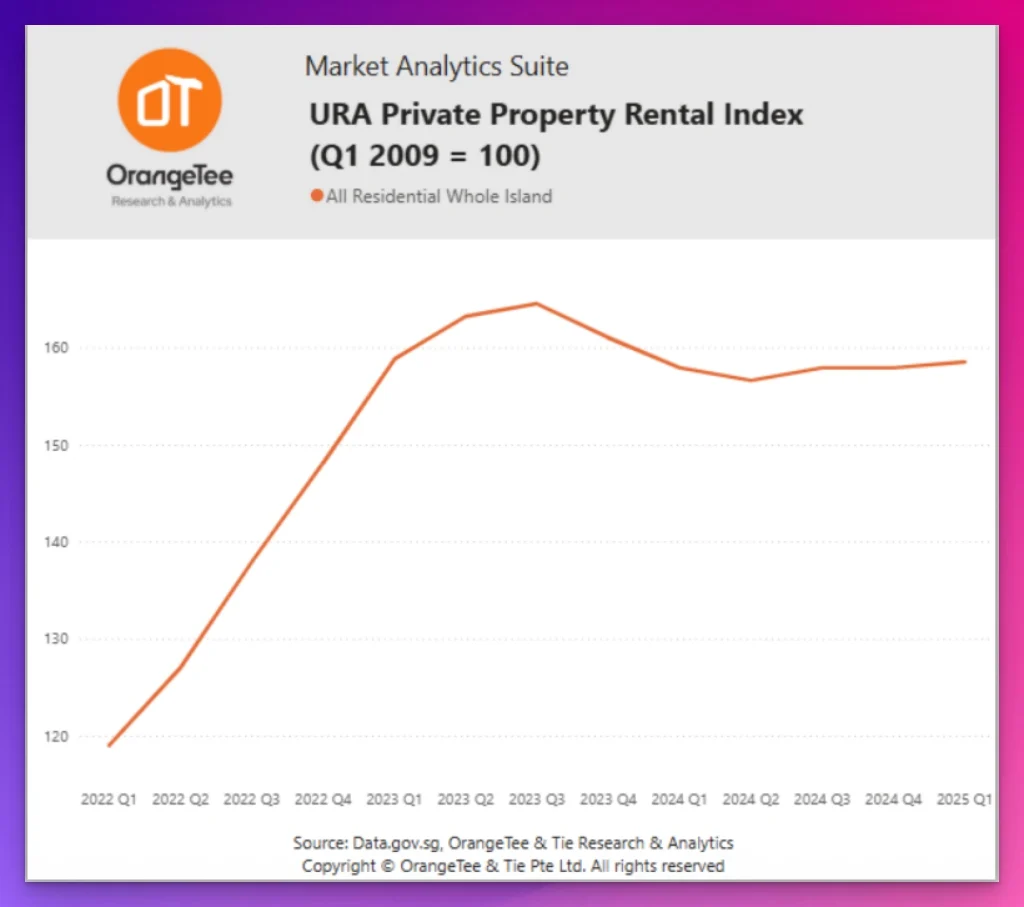

Singapore Private Rental Prices Edge Upward After Steady Q4 2024

The Urban Redevelopment Authority (URA) rental index reveals private residential rents increased by 0.4% in Q1 2025, following a period of price stability in the preceding quarter. This modest uptick signals renewed market momentum as Singapore’s rental sector continues its post-pandemic evolution.

Landed properties showed a 0.3% growth in rental prices, successfully reversing the 1.8% decline observed in Q4 2024. Similarly, non-landed properties experienced a 0.5% increase, building on the minor 0.2% growth recorded in the previous quarter.

The consistent price appreciation across property types indicates strengthening market fundamentals despite broader economic uncertainties.

Regional Analysis: Core Central Region vs Suburban Rentals

Condominium rental prices demonstrated consistent quarter-on-quarter gains across all market segments in early 2025.

Prime area properties in the Core Central Region (CCR) and city fringe properties in the Rest of Central Region (RCR) both registered 0.4% price increases, continuing their upward trajectory from the previous quarter.

Most notably, suburban condominiums in the Outside Central Region (OCR) showed the strongest growth at 0.7% quarter-on-quarter, reversing the 0.8% decline seen in Q4 2024.

This suburban resurgence highlights shifting tenant preferences and potential supply constraints in these areas, making them increasingly attractive to investors focused on rental yields.

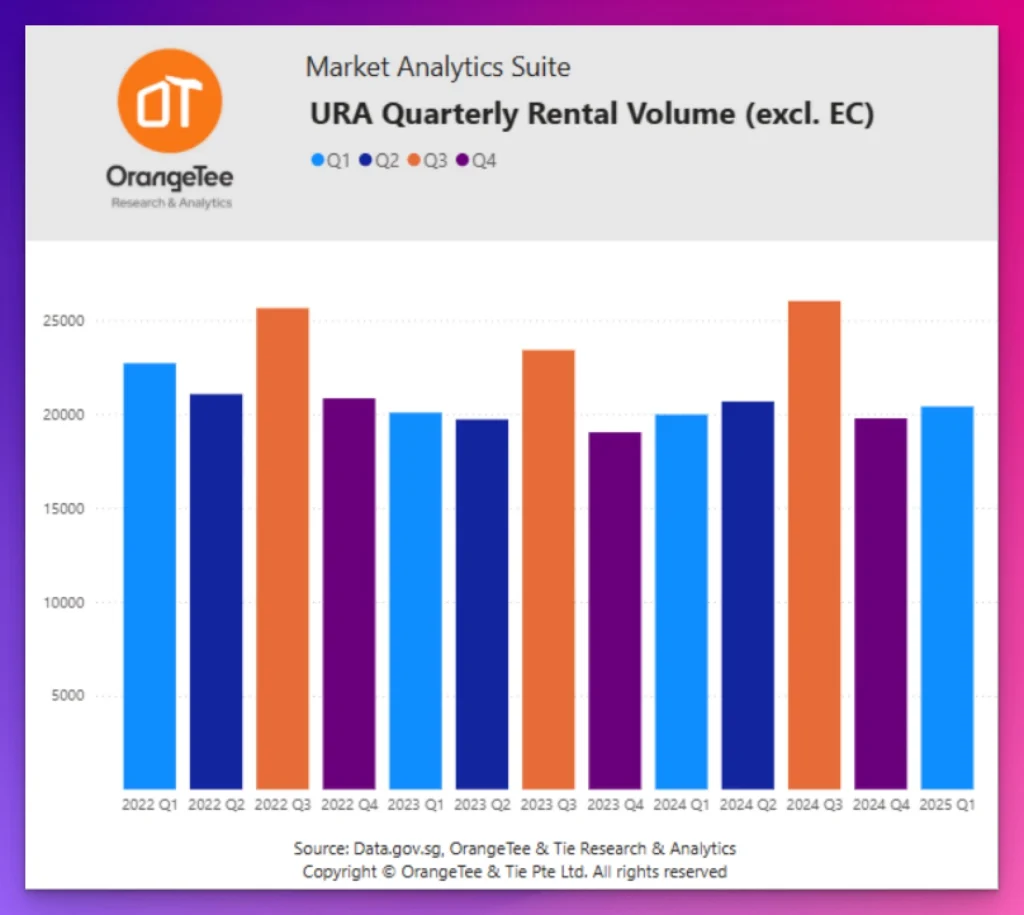

Rental Volume Surges 3.2% Following Holiday Season

According to URA REALIS data, private non-landed rental transactions increased by 3.2% from 19,782 units in Q4 2024 to 20,409 units in Q1 2025.

This welcome reversal follows the 24% quarter-on-quarter decline observed during the previous quarter and represents a 2.1% year-on-year increase compared to Q1 2024.

The heightened activity can be attributed to tenant returns after the holiday period, with overall occupancy rates climbing to 93.5% in Q1 2025. This high occupancy level suggests strong underlying demand despite economic headwinds facing the global economy.

Supply Constraints: New Completions Drop 35.5%

A key factor influencing rental market dynamics is the significant reduction in new supply entering the market. The first quarter saw just 1,988 private residential units completed, representing a 35.5% decrease from the 3,084 units delivered in Q4 2024.

URA projections indicate approximately 3,932 additional units will be completed during the remainder of 2025, averaging around 1,311 units per quarter from Q2 through Q4.

This limited pipeline will inevitably place upward pressure on rental rates as demand continues to outpace supply in popular locations.

Singapore Top Rental Projects: D’Leedon Leads Transaction Volume

In the Core Central Region, D’Leedon emerged as the most popular condominium project with 127 rental transactions during Q1 2025. One-bedroom units commanded median monthly rents of $3,900, while three-bedroom apartments achieved $7,500 per month.

Marina One Residences followed closely with 115 transactions and premium rental rates of $4,700 for one-bedroom units and $10,000 for three-bedroom configurations.

The Sail @ Marina Bay rounded out the top three with 114 transactions, demonstrating continued strong demand for luxury waterfront properties.

Other Related Articles:

City Fringe Dominance: Normanton Park Sets the Pace

Normanton Park maintained its position as the most sought-after rental development in the Rest of Central Region, recording 173 transactions during Q1 2025. One-bedroom units achieved median rents of $3,300, while three-bedroom apartments commanded $5,300 monthly.

One Pearl Bank followed with 129 transactions and considerably higher rental rates—$4,100 for one-bedroom units and $7,550 for three-bedroom apartments—reflecting its premium positioning and attractive city-fringe location.

Singapore Suburban Rental Hotspots: Watertown and Treasure at Tampines

In the Outside Central Region, Watertown in Punggol emerged as the leading rental destination with 97 transactions. One-bedroom units achieved median monthly rents of $3,100, with three-bedroom apartments commanding $5,300.

Treasure at Tampines registered 92 transactions, with more affordable rental rates of $2,800 for one-bedroom units and $4,400 for three-bedroom apartments, highlighting the value proposition of larger suburban developments.

MOST POPULAR CONDOS IN Q1 2025

(BASED ON HIGHEST NUMBER OF RENTAL TRANSACTIONS)

| Project Name | Address | Total Transactions | Median Rents SGD Per month (1 Bedroom) | Median Rents SGD Per month (2 Bedroom) | Median Rents SGD Per month (3 Bedroom) |

Core Central Region (CCR)

| D’LEEDON | LEEDON HEIGHTS | 127 | $3,900 | $5,400 | $7,500 |

| MARINA ONE RESIDENCES | MARINA WAY | 115 | $4,700 | $7,400 | $10,000 |

| THE SAIL @ MARINA BAY | MARINA BOULEVARD | 114 | $4,325 | $6,350 | $7,900 |

| DUO RESIDENCES | FRASER STREET | 83 | $4,750 | $7,000 | $10,500 |

| ONE HOLLAND VILLAGE RESIDENCES | HOLLAND VILLAGE WAY | 82 | $3,800 | $5,350 | $8,000 |

| THE AVENIR | RIVER VALLEY CLOSE | 82 | $4,325 | $6,500 | $9,400 |

| ICON | GOPENG STREET | 79 | $4,200 | $6,150 | NA |

| THE M | MIDDLE ROAD | 77 | $4,000 | $5,000 | $7,100 |

Rest of Central Region (RCR)

| NORMANTON PARK | NORMANTON PARK | 173 | $3,300 | $4,200 | $5,300 |

| ONE PEARL BANK | PEARL BANK | 129 | $4,100 | $5,300 | $7,550 |

| PARC ESTA | SIMS AVENUE | 119 | $3,500 | $4,600 | $5,800 |

| REFLECTIONS AT KEPPEL BAY | KEPPEL BAY VIEW | 90 | NA | $5,950 | $8,725 |

| JADESCAPE | SHUNFU ROAD | 83 | $3,400 | $4,400 | $5,900 |

| CITY SQUARE RESIDENCES | KITCHENER LINK | 80 | $3,500 | $4,600 | $6,000 |

| SIMS URBAN OASIS | SIMS DRIVE | 79 | $3,100 | $3,950 | $5,000 |

| SKY VUE | BISHAN STREET 15 | 74 | $3,300 | $4,100 | $6,000 |

Outside of Central Region (OCR)

| WATERTOWN | PUNGGOL CENTRAL | 97 | $3,100 | $4,000 | $5,300 |

| TREASURE AT TAMPINES | TAMPINES LANE | 92 | $2,800 | $3,375 | $4,400 |

| PARC CLEMATIS | JALAN LEMPENG | 87 | $3,200 | $4,175 | $5,550 |

| J GATEWAY | GATEWAY DRIVE | 84 | $3,700 | $4,500 | $6,000 |

| MELVILLE PARK | SIMEI STREET 1 | 70 | NA | $3,400 | $4,200 |

| BAYSHORE PARK | BAYSHORE ROAD | 69 | $2,800 | $3,600 | $4,400 |

| HIGH PARK RESIDENCES | FERNVALE ROAD | 68 | $2,600 | $3,100 | $3,650 |

| HILLION RESIDENCES | JELEBU ROAD | 67 | NA | $3,750 | NA |

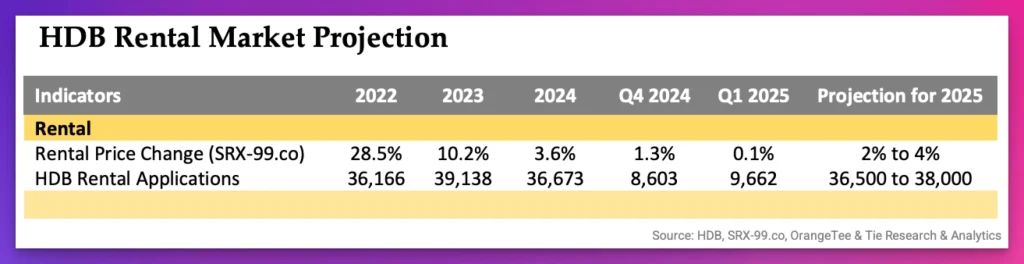

HDB Rental Market: Applications Surge 12.3% in Q1

The public housing rental segment demonstrated remarkable resilience in early 2025, with HDB rental applications increasing by 12.3% from 8,603 in Q4 2024 to 9,662 in Q1 2025.

This strong rebound reverses two consecutive quarters of declining activity and signals renewed interest in Singapore’s most accessible rental market.

According to the SRX-99.co HDB rental price index, rental rates remained relatively stable with a marginal 0.1% increase during Q1 2025, moderating from the 1.3% growth observed in the previous quarter.

This stabilisation suggests a balancing of market forces despite the limited supply of newly-eligible rental units.

Economic Headwinds: Potential Impact on Rental Recovery

Despite positive market indicators, Singapore’s rental sector faces potential challenges from broader economic uncertainties.

The International Monetary Fund’s recent World Economic Outlook report has adjusted global growth projections downward, highlighting concerns about international trade tensions and potential tariff complications.

These macroeconomic pressures may prompt multinational companies to adopt more conservative expatriate hiring policies, potentially moderating demand for premium rental properties in Singapore’s prime districts.

However, the significant reduction in new supply completions will likely provide a counterbalance to any demand-side weakening.

MOP Supply Constraints: Limited New HDB Rental Stock

A critical factor influencing HDB rental dynamics is the substantial reduction in flats reaching their Minimum Occupation Period (MOP) during 2025.

Approximately 6,973 flats will become eligible for rental arrangements this year, representing a 41.7% decrease from the 11,952 units that achieved MOP in 2024.

This supply constraint, coupled with Singapore’s improving employment outlook and easing inflationary pressures, creates conditions for continued rental price appreciation in the public housing segment. The return of foreign students and expatriate workers further strengthens this outlook.

Interest Rate Relief: Potential Catalyst for Market Activity

The anticipated reduction in interest rates presents a potential bright spot for Singapore’s rental market in 2025. Lower financing costs should theoretically reduce operational expenses for property investors and landlords, potentially moderating rental price pressures.

This interest rate environment may also stimulate additional investment in rental properties, although the limited supply of new completions will continue to act as a constraint on market expansion in the near term.

Singapore 2025 Market Projections: Moderate Growth Expected

Looking ahead, property analysts project that overall private residential rents will increase between 2% and 4% for the entire year 2025. Transaction volumes are expected to stabilise within the range of 78,000 to 82,000 units, reflecting a sustainable level of market activity.

Similarly, HDB rental rates are forecast to appreciate by 2% to 4% in 2025, with leasing volumes remaining stable at approximately 36,500 to 38,000 approved rental applications.

These projections indicate a measured yet healthy rental market performance, despite challenging global economic conditions.

Strategic Implications for Property Investors and Tenants

For property investors, the current market conditions present both opportunities and challenges. The limited supply pipeline and steady demand fundamentals support potential rental yield improvements, particularly in suburban locations experiencing the strongest price appreciation.

Tenants may find increased negotiating leverage in certain market segments as landlords compete for quality occupants in a competitive landscape. However, the continued supply constraints will likely prevent any significant rental price corrections in the near term.

As Singapore’s rental market navigates through 2025, maintaining a balanced perspective on both local market dynamics and broader economic forces will be essential for stakeholders seeking to optimize their property decisions in this evolving landscape.

The content source is from the OrangeTee & Tie Research & Analytics link

Disclaimer: This information is provided for informational purposes only. PropsBit.com.sg does not endorse or guarantee its relevance or accuracy concerning your situation. While careful efforts have been taken to ensure the content’s correctness and reliability at the time of publication, it should not replace personalised advice from a qualified professional. We highly recommend against relying solely on this information for financial, investment, property, or legal decisions, and we accept no responsibility for choices made based on this content.