Will HDB Flat Be More Affordable? Exploring the New BTO Classification and Its Impact on Singapore’s Housing Market

Singapore’s public housing landscape is undergoing a significant shift with the introduction of a new Build-to-Order (BTO) classification system. Announced by Prime Minister Lee Hsien Loong, this new model replaces the long-standing categorization of flats into mature and non-mature estates with a fresh framework: Standard, Plus, and Prime flats. This change aims to address the perennial challenge of housing affordability while ensuring fairness and access to desirable locations for Singaporeans.

In this comprehensive exploration, inspired by a detailed discussion hosted by CNA Insider, we delve into what this new classification means for homebuyers, the affordability challenges faced by young adults, the dynamics of resale flat pricing, and the future of public housing in Singapore. We also examine innovative construction technologies that promise to improve supply and reduce waiting times, alongside debates about flat sizes and the evolving aspirations of Singaporeans when it comes to homeownership.

Table of Contents

- 🔍 Understanding the New BTO Classification: Standard, Plus, and Prime Flats

- 💡 Will This New Model Make HDB Flats More Affordable?

- 📈 The Risk of Sellers Clawing Back Subsidies and Impact on Prices

- 📊 Young Adults and the Challenge of Housing Affordability

- 🏘️ Why Are BTO Prices Increasing, Even in Non-Mature Estates?

- ⏳ The Long Wait for BTO Flats: Is It Like Striking a Lottery?

- 🏠 Resale Flats: The Next Best Option for Many

- 👩👧👦 Addressing the Needs of Vulnerable Groups

- 🏗️ Innovations in Construction to Boost Housing Supply 🚧

- 📉 Why Are HDB Flats Getting Smaller? And What Does It Mean for Homeowners?

- 🏘️ Maximizing Flat Flexibility for Future Needs

- 🏢 The Decline of Five-Room Flats in Prime Estates and Its Implications

- 🔚 Conclusion: Navigating the Future of Public Housing Affordability in Singapore

- ❓ Frequently Asked Questions (FAQ) ❓

🔍 Understanding the New BTO Classification: Standard, Plus, and Prime Flats

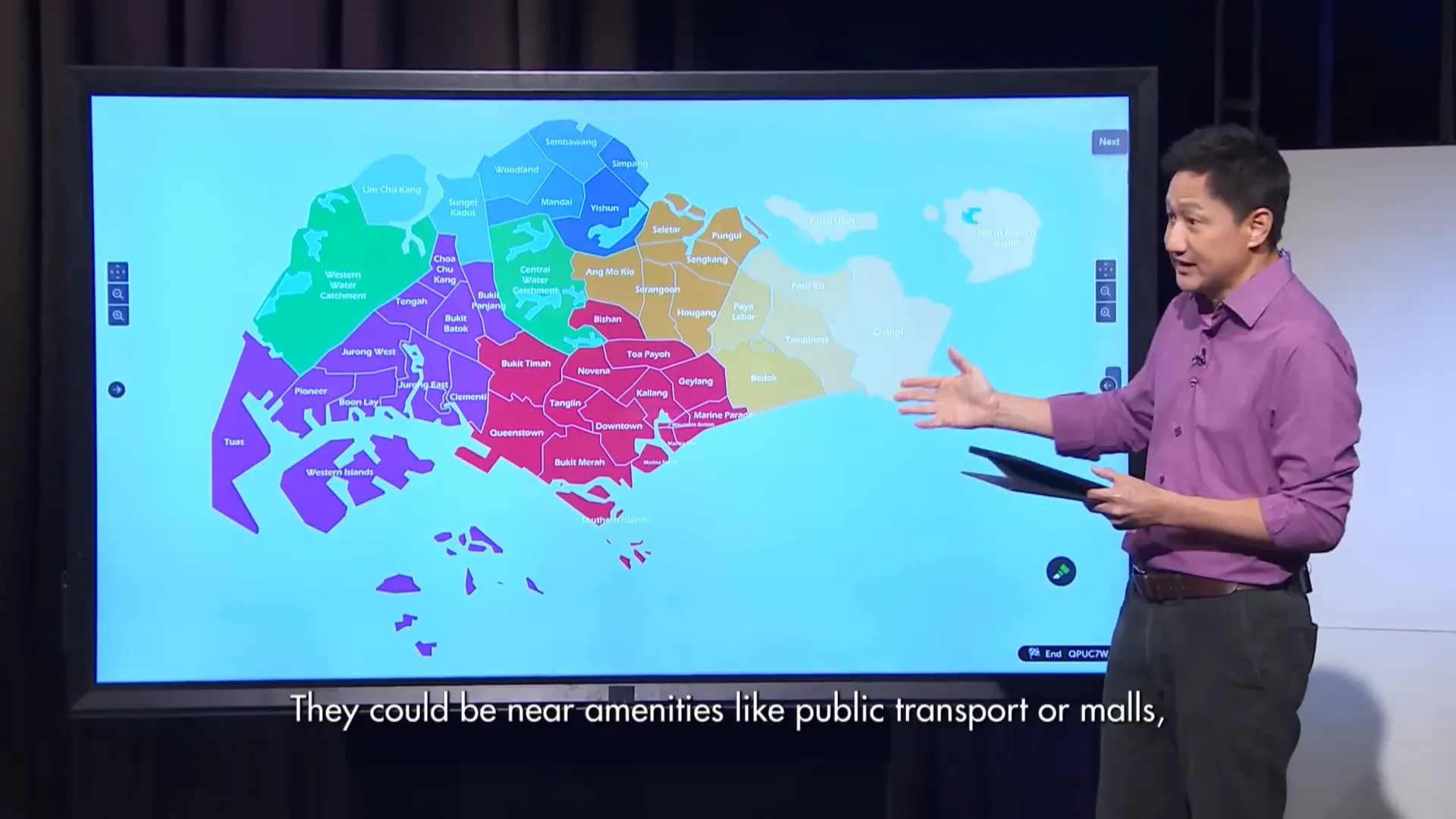

The government’s decision to reclassify BTO flats into Standard, Plus, and Prime categories is a strategic move to better reflect the location and accessibility of public housing, while adjusting subsidies and resale conditions accordingly.

- Standard Flats: These will constitute the majority of public housing and are generally located in less central or less developed areas. They will continue to receive the general subsidies that have been in place.

- Plus Flats: Located in choice regions such as the East, North, and West of Singapore, Plus flats are near amenities like public transport hubs and shopping malls. These flats will come with increased subsidies but also tighter resale restrictions to maintain fairness.

- Prime Flats: Found in more centrally located areas — the heart of the city and well-connected zones — Prime flats will receive the highest subsidies and face the strictest resale restrictions.

By aligning subsidies with location desirability and imposing resale conditions, the government aims to maintain affordability and fairness, especially in sought-after areas.

💡 Will This New Model Make HDB Flats More Affordable?

At the core of these changes is the question: Will HDB flat be more affordable? The government’s approach is to ensure that while subsidies increase for flats in more desirable locations, resale restrictions will prevent excessive price escalation.

Housing expert Nicholas Lee highlights that the majority of flats will remain Standard flats with existing subsidy levels, ensuring broad accessibility. The challenge is to balance providing more flats in choice locations with maintaining a fair and affordable system. This is why tighter resale conditions accompany the increased subsidies for Plus and Prime flats — to prevent owners from immediately flipping flats for large profits and pushing prices beyond reach.

However, the true test will come when these flats hit the market in the second half of 2024, as the first batch of Plus and Prime flats will carry a 10-year Minimum Occupation Period (MOP) before they can be resold. This long MOP is intended to stabilize prices and curb speculation.

Pricing for these flats will also serve as a form of price discovery, allowing the government to gauge public acceptance of subsidy levels and resale conditions.

📈 The Risk of Sellers Clawing Back Subsidies and Impact on Prices

A common concern raised by viewers is whether sellers will attempt to reclaim subsidies by inflating resale prices. Nicholas Lee explains that this risk exists primarily in a seller’s market, where sellers have the leverage to set higher prices. However, if prices become too inflated beyond what buyers are willing to pay, flats will remain unsold, naturally tempering price hikes.

Nonetheless, if many sellers simultaneously try to claw back subsidies, it could push prices up across the board, impacting affordability. This underscores the importance of the government’s resale restrictions and monitoring mechanisms.

📊 Young Adults and the Challenge of Housing Affordability

According to a study by research company Milli, 77% of Singaporeans aged 25 to 34 find housing costs unaffordable. This demographic, often just starting their careers and families, faces unique pressures compared to previous generations.

Property consultant Juann Tan reflects on how younger Singaporeans perceive the housing market differently. Past generations benefitted from “windfall gains” and a property “lottery effect” — buying flats cheaply, selling them at profits, and upgrading over time. Today’s young buyers, however, grapple with high interest rates, inflation, and rising resale prices, making wealth accumulation through HDB flats more challenging.

With the new classification system, buyers will still have access to affordable flats but must accept resale restrictions that may limit rapid wealth growth. This represents a shift in housing as a stepping stone for wealth accumulation.

🏘️ Why Are BTO Prices Increasing, Even in Non-Mature Estates?

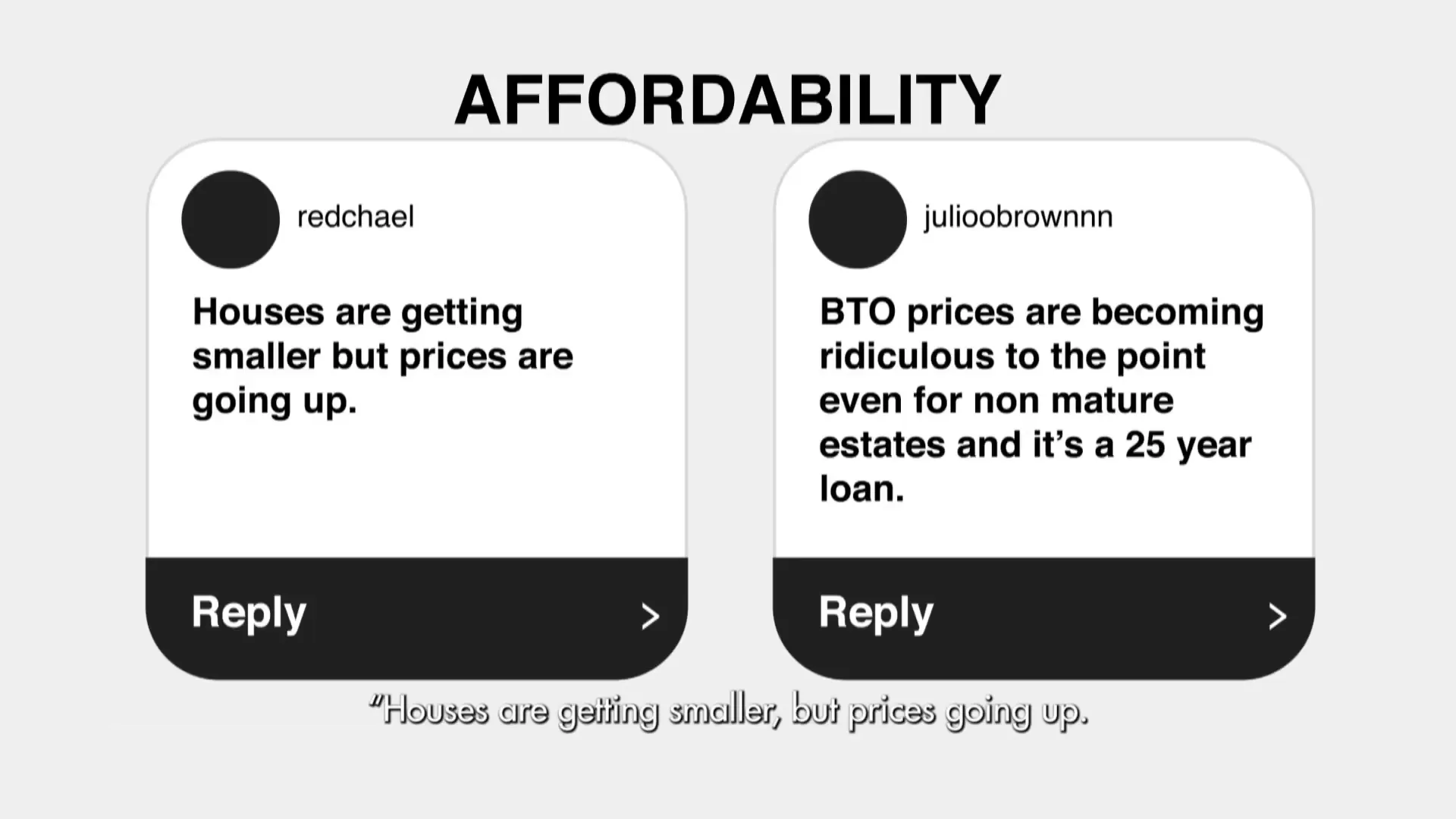

Some viewers have noted that BTO prices are rising even in non-mature estates, sparking questions about affordability.

Housing economist Henry Tan explains that the average BTO price increase reflects the changing mix of flats built over the years. More BTOs have been constructed in mature estates to respond to public demand for proximity to amenities and family, which naturally drives up average prices.

Moreover, statistics show that prices of BTO flats in non-mature estates have remained relatively stable over the past decade, suggesting that the rise in average prices is due to the inclusion of more mature estate flats rather than a uniform price increase.

However, Juann Tan points out that the immediate housing needs of many Singaporeans are met through resale flats, not BTOs, and resale flat prices continue to rise without the same subsidy controls, intensifying affordability challenges.

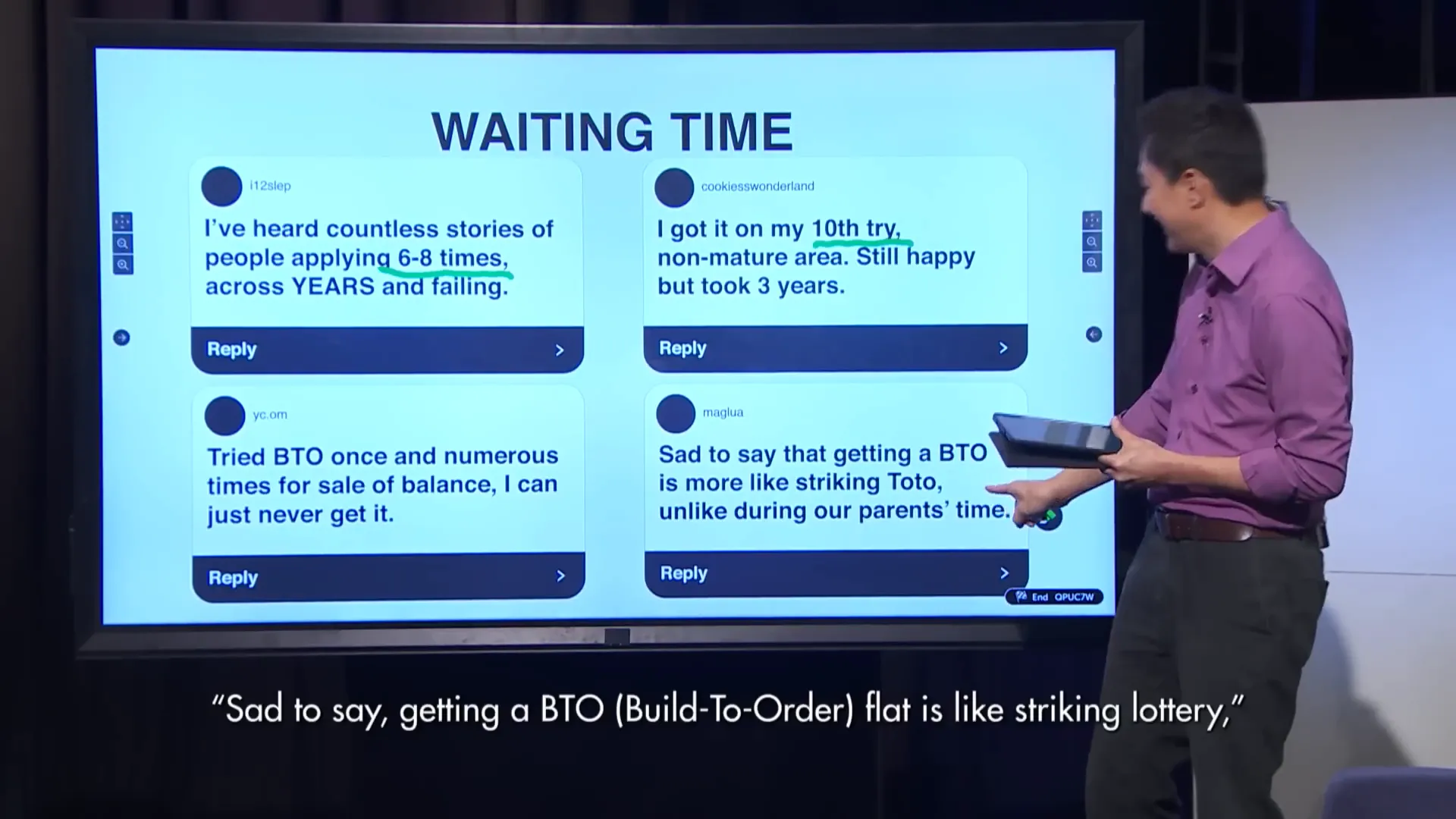

⏳ The Long Wait for BTO Flats: Is It Like Striking a Lottery?

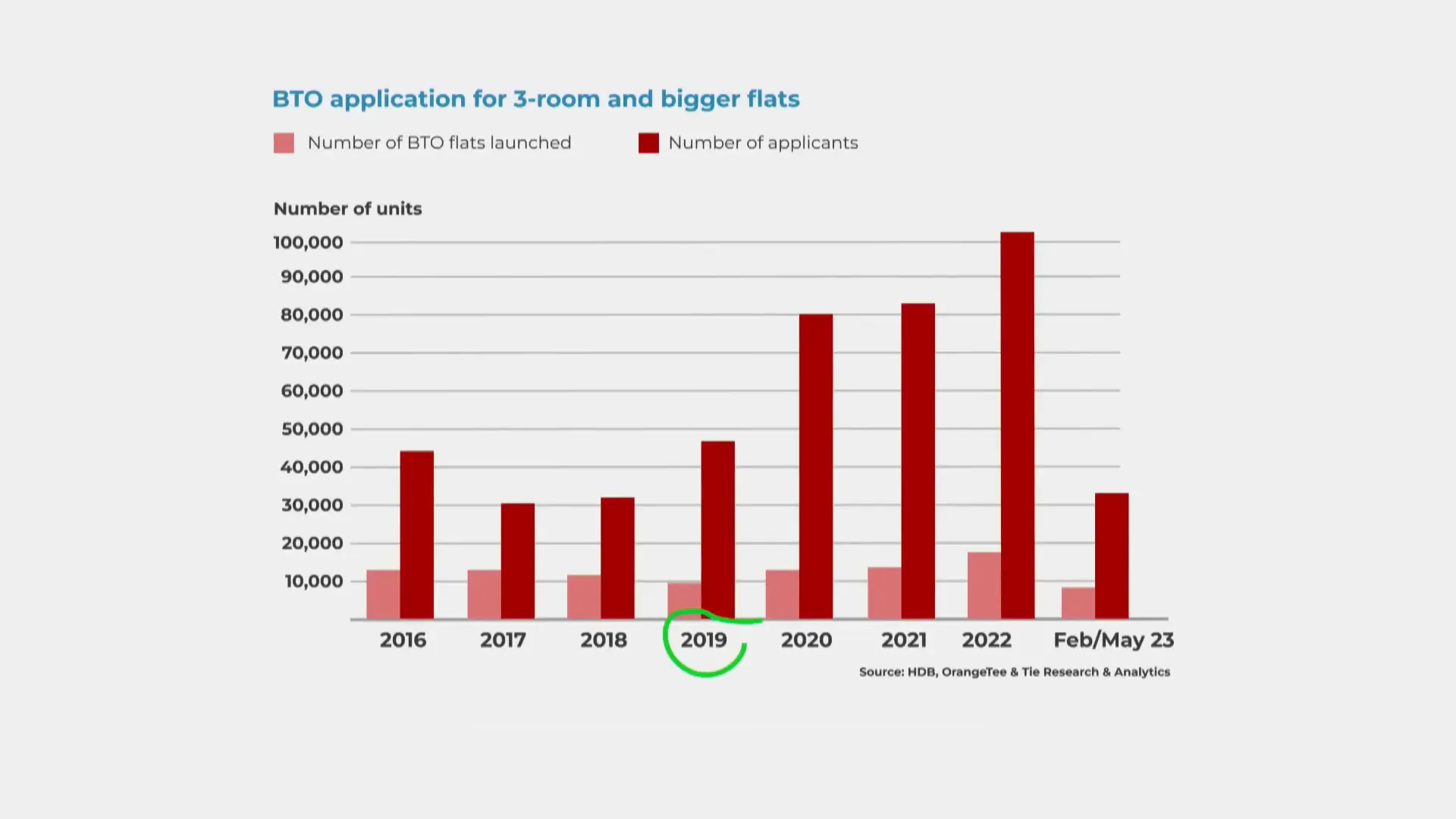

One of the most frequently voiced frustrations is the lengthy wait times for BTO flats. Many applicants report applying multiple times over several years without success, likening the process to a lottery.

Thomas Voon, a seasoned housing project manager, shares insights into the supply-demand imbalance. For instance, in 2019, there were approximately 45,000 applicants for only 10,000 BTO flats, giving applicants roughly a one in four chance of securing a flat.

The spike in applications in 2019 was influenced by a recovering property market after years of price declines and the onset of the COVID-19 pandemic in 2020, which affected construction and supply. Despite demographic data, market sentiment and the property cycle heavily influence demand, making it challenging to perfectly forecast and match supply.

The government has responded by increasing the number of flats launched — 23,000 flats were rolled out last year and a similar number planned for this year — but demand remains highly volatile.

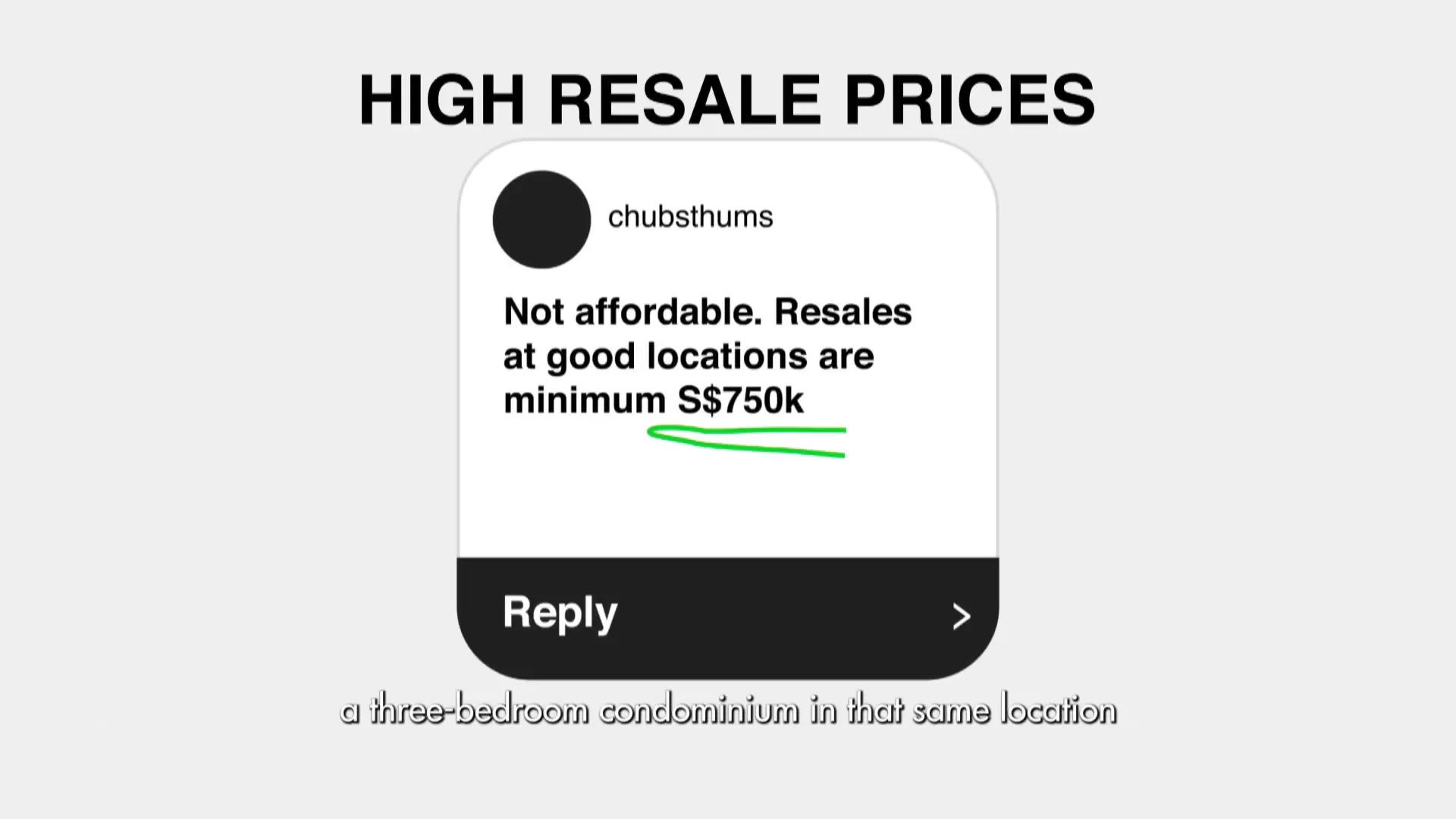

🏠 Resale Flats: The Next Best Option for Many

For those unable to secure a BTO flat, resale flats often become the fallback option. However, soaring resale prices, especially in good locations, have made this option increasingly out of reach for many. Prices for resale flats near prime areas can start from $750,000 for a three-room flat, a steep barrier for many first-time buyers.

The new BTO classification model aims to create a two-tier resale market. Flats under the new categories with resale restrictions might see moderated price growth, while a large portion of existing resale flats without these restrictions could continue to see price appreciation.

Rising private condominium prices also exert upward pressure on resale HDB prices, as those priced out of private property often turn to HDB flats in central locations, driving demand and prices higher.

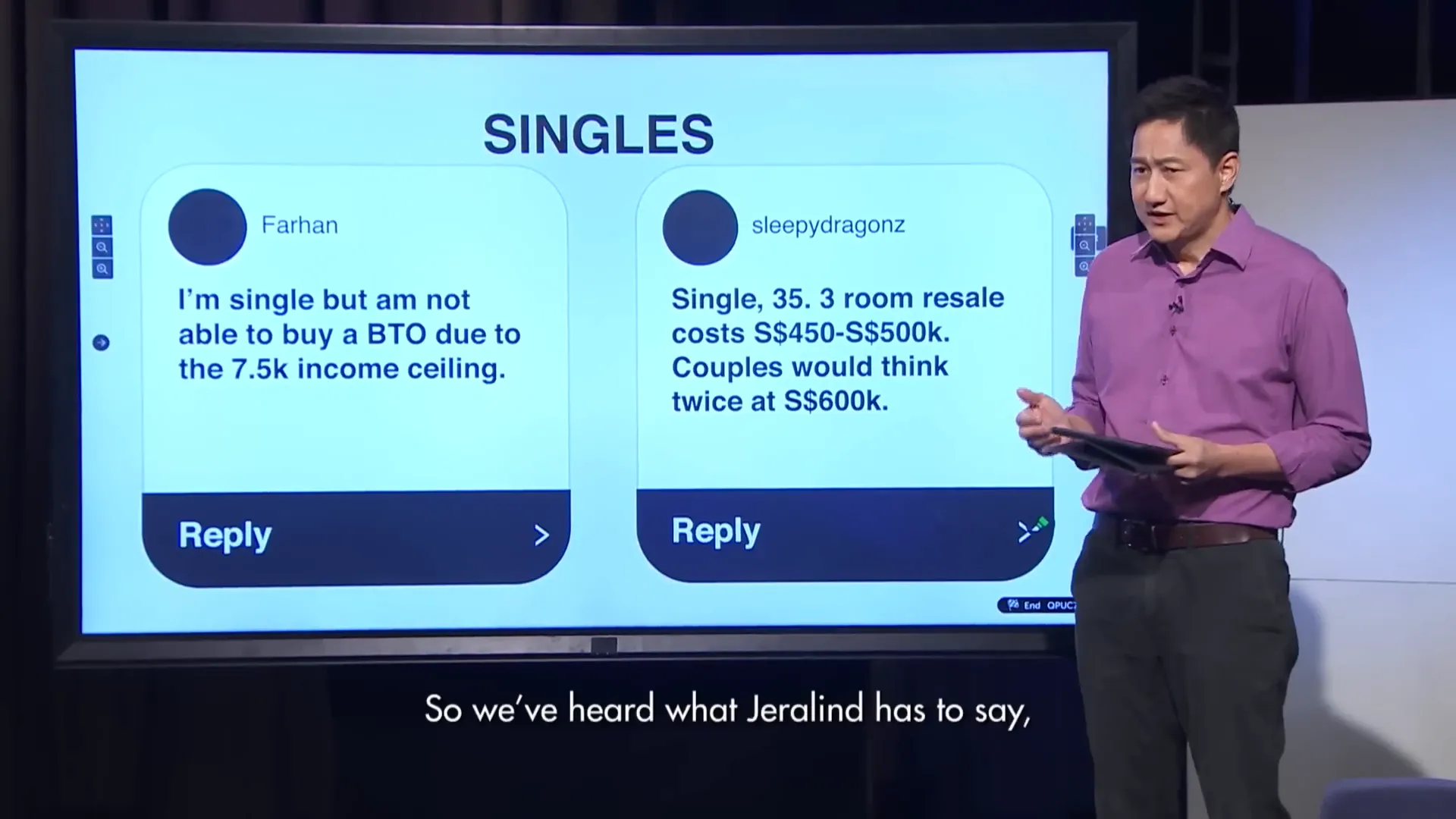

👩👧👦 Addressing the Needs of Vulnerable Groups

The rising cost of resale flats has disproportionately affected vulnerable groups such as single parents, divorced individuals, and single unwed mothers. Geralyn’s story, shared during the discussion, highlights the struggle of a single mother with four children who faces long waiting times for BTO flats and finds resale flats unaffordable or requiring costly renovations.

Housing experts acknowledge that while subsidies for resale flats have increased, gaps remain. Some groups fall through the cracks, unable to access regular schemes or afford resale prices. There is a call for more tailored support and flexibility to help these Singaporeans secure housing.

Joann Tan also notes that some sellers factor anticipated government subsidies into their asking prices, which can further inflate resale flat prices, a phenomenon difficult to regulate.

🏗️ Innovations in Construction to Boost Housing Supply 🚧

To address supply constraints and reduce waiting times, the construction industry is adopting new technologies and productivity-enhancing tools.

- E-Trolleys: These motorized trolleys transport construction materials like cement more efficiently than traditional wheelbarrows, doubling the volume moved per trip.

- Building Information Modeling (BIM): BIM uses 3D digital models to map out every step in the construction process, aligning designers and contractors to reduce mistakes and rework.

These advancements have been shown to improve productivity by at least 20% on public housing sites. Although not yet universally adopted, more than half of construction contracts currently employ BIM. The main barriers include the high cost of software (around half a million per project) and a shortage of skilled workers, exacerbated by pandemic-related labor shortages.

With increased productivity, the Housing and Development Board (HDB) aims to reduce BTO waiting times to under three years for certain flats by 2024, and maintain an average wait time of three to four years by 2025, returning to pre-pandemic levels.

📉 Why Are HDB Flats Getting Smaller? And What Does It Mean for Homeowners?

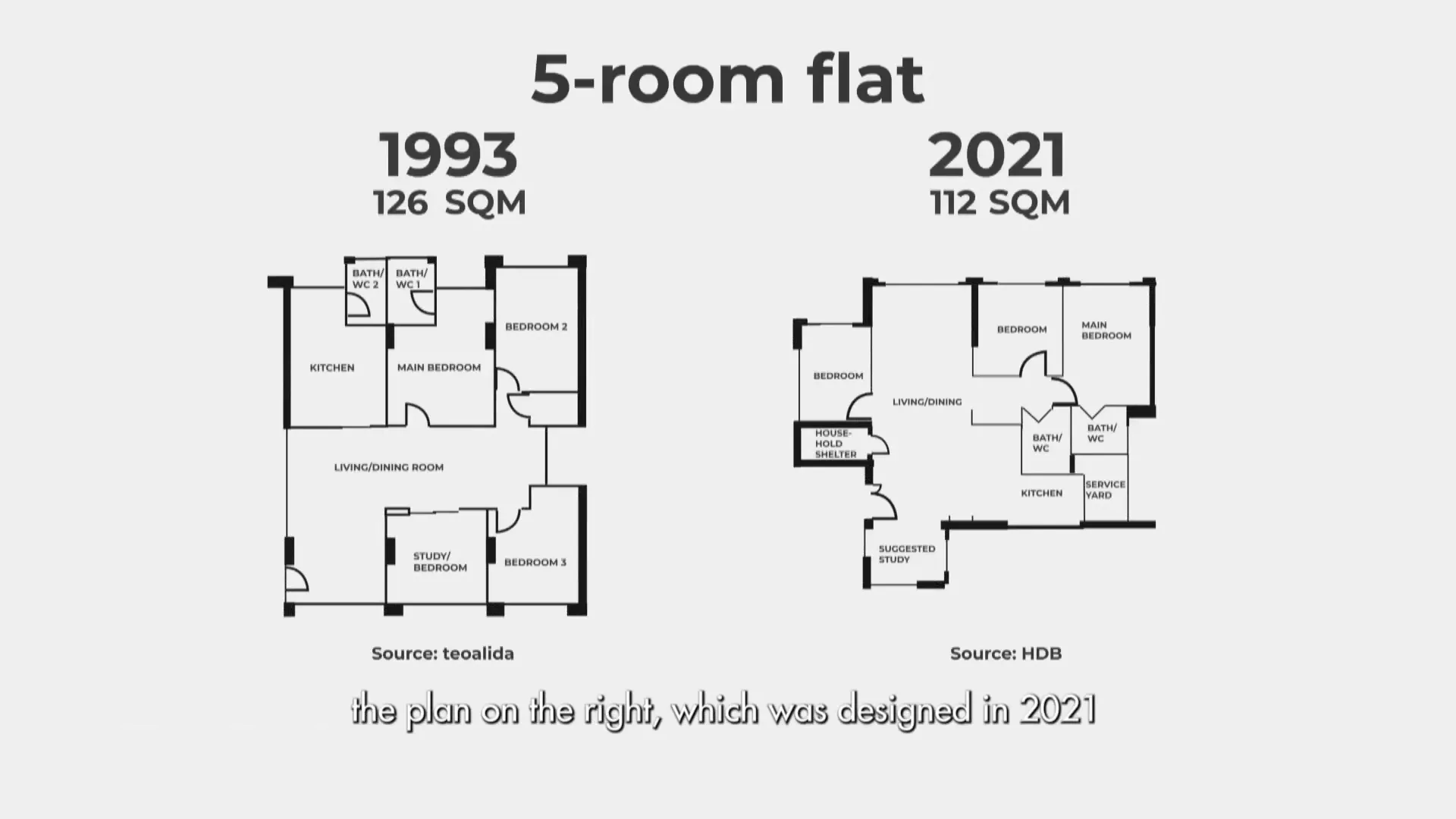

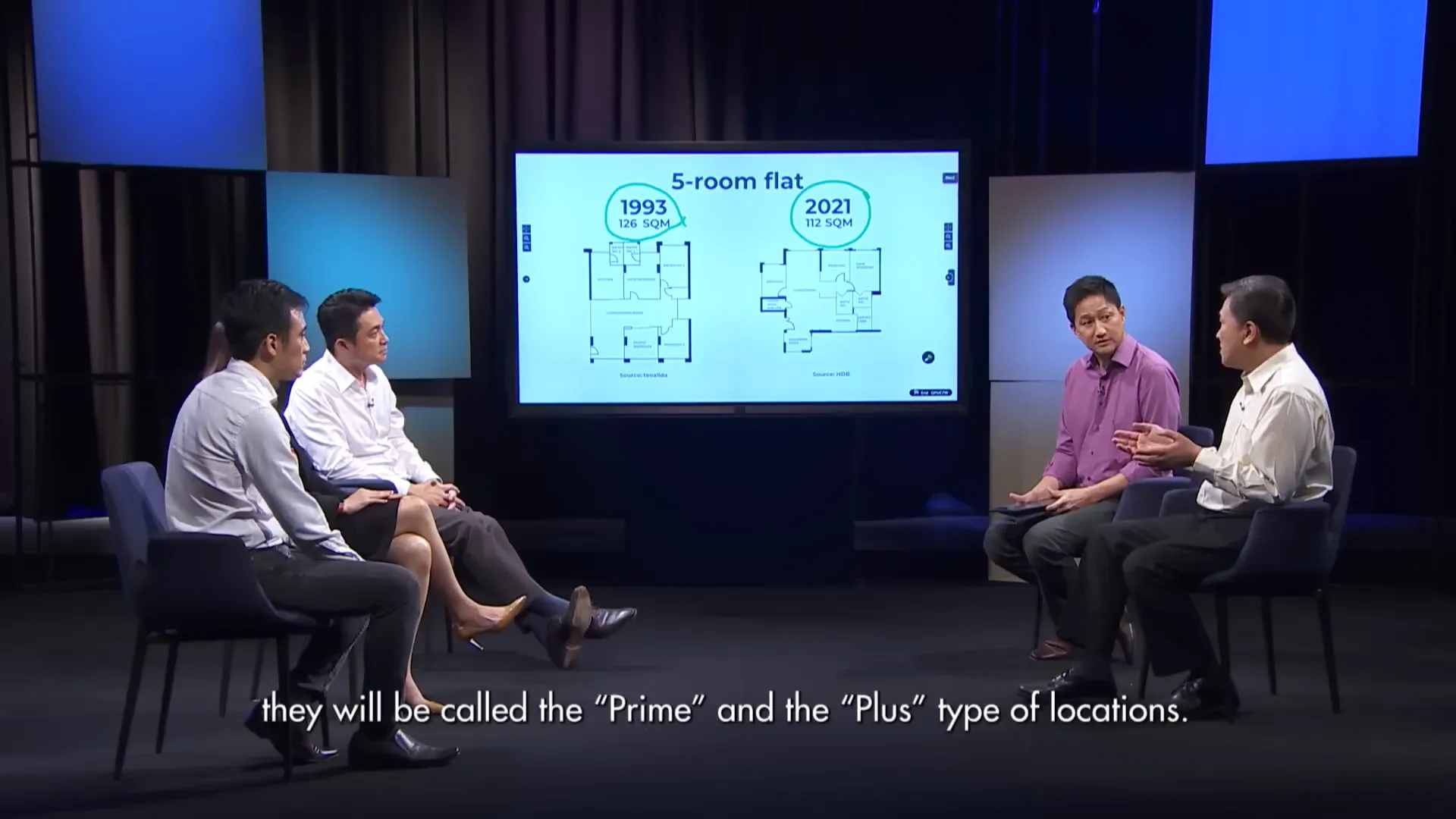

One of the common complaints from Singaporeans is that while flat prices rise, the size of flats is shrinking. A comparison between five-room flats built in 1993 and those in 2021 shows a reduction in size by nearly 10%.

Michael Leong, a housing planner, explains that while absolute unit sizes have decreased slightly, the space per capita — considering the smaller average household size today — has remained fairly consistent. Additionally, newer flats offer more flexible layouts, allowing residents to reconfigure spaces to suit their needs.

However, property consultant Nicholas Lee cautions against relying solely on per capita space metrics to justify smaller flats. Essential spaces such as for a refrigerator, dining table, and living area remain constant regardless of household size. Shrinking flats may challenge national objectives to encourage larger families, as cramped living spaces can be a deterrent to having more children.

There is also concern that the trend of smaller flats in public housing influences private developers to build smaller condominium units, further impacting housing quality across the board.

Juann Tan adds that some families occupy larger flats than they strictly need, often because they can afford it or prefer the space, while others genuinely require larger homes. Prioritizing space for those who need it most is a key consideration in public housing planning.

🏘️ Maximizing Flat Flexibility for Future Needs

Looking ahead, designing flats with maximum flexibility is crucial to accommodate evolving family structures and lifestyles. Modern flats incorporate features like open-concept living spaces, cross ventilation, and adaptable room configurations that can be modified over time.

The contrast between a flat layout from 1993 and one from 2021 illustrates this shift towards more open, flexible living environments that better cater to diverse needs across a family’s lifespan.

Such design innovations help make smaller flats feel more spacious and functional, enhancing livability despite size constraints.

🏢 The Decline of Five-Room Flats in Prime Estates and Its Implications

Interestingly, HDB has recently stopped offering new five-room flats in popular estates near MRT stations — areas that will be classified as Prime or Plus. Instead, the largest flats offered in these locations are now four-room units.

Nicholas Lee warns that this policy may lead to a shortage of larger flats in prime locations, causing prices of existing five-room flats to surge due to rarity. This could create affordability issues for larger families seeking homes in central areas.

Experts suggest that while increasing the number of smaller flats allows for more units overall, the need for larger flats in choice locations remains a valid concern that policymakers should consider.

🔚 Conclusion: Navigating the Future of Public Housing Affordability in Singapore

The new BTO classification system marks an important step in Singapore’s ongoing efforts to balance housing affordability, accessibility, and fairness. By introducing Standard, Plus, and Prime categories with differentiated subsidies and resale restrictions, the government aims to offer more flats in desirable locations without sacrificing affordability for the broader population.

However, challenges remain. The high demand for flats, fluctuating market sentiments, rising resale prices, and the needs of vulnerable groups underscore the complexity of public housing policy. Innovations in construction technology promise to improve supply and reduce wait times, but affordability pressures from both public and private housing markets persist.

Moreover, trends like shrinking flat sizes and the decline of larger flats in prime locations raise questions about how well public housing can meet the diverse needs and aspirations of Singaporean families today and in the future.

Ultimately, will HDB flat be more affordable? The answer is nuanced. The new classification system offers a promising framework to improve fairness and access, but ongoing adjustments, targeted support for vulnerable groups, and thoughtful urban planning will be essential to ensure that affordable, quality homes remain within reach for all Singaporeans.

❓ Frequently Asked Questions (FAQ) ❓

What are the new BTO flat classifications and how do they differ?

BTO flats will be categorized into Standard, Plus, and Prime. Standard flats make up most of the supply with general subsidies. Plus flats are in choice locations with more subsidies and tighter resale restrictions. Prime flats are centrally located with the highest subsidies and strictest resale conditions.

How will the new classification affect flat prices and subsidies?

Flats in Plus and Prime categories will have increased subsidies to improve affordability but come with resale restrictions like a longer Minimum Occupation Period (MOP), helping to prevent sharp price increases. Standard flats will continue with existing subsidy levels.

Why do young adults still find BTO flats unaffordable?

Young adults face challenges like high interest rates, inflation, and rising resale prices. Unlike past generations, the new resale restrictions may slow wealth accumulation through HDB flats. Immediate housing needs often push them to the resale market, where prices are less controlled.

Why are resale flat prices rising despite new policies?

Resale flat prices are influenced by demand, limited supply, and rising private property prices. Some resale flats are not subject to the new restrictions, allowing prices to rise. Additionally, sellers sometimes factor government subsidies into their asking prices.

What is being done to reduce BTO waiting times?

Technologies like e-trolleys and Building Information Modeling (BIM) improve construction productivity. HDB plans to launch more flats and aims to reduce wait times to under three years for certain flats by 2024, with an average of three to four years by 2025.

Why are HDB flats getting smaller?

Flats have become smaller due to smaller household sizes and land constraints. However, space per capita remains consistent, and newer flats offer more flexible layouts. There is concern this trend might impact family growth and influence private developers to build smaller units.

Are there enough larger flats in prime locations?

HDB has reduced the offering of five-room flats in prime estates, focusing on four-room flats to increase unit numbers. This may cause existing five-room flats in these areas to become rarer and more expensive, which is a concern for larger families.

Disclaimer: This information is provided for informational purposes only. PropsBit.com.sg does not endorse or guarantee its relevance or accuracy concerning your situation. While careful efforts have been taken to ensure the content’s correctness and reliability at the time of publication, it should not replace personalised advice from a qualified professional. We highly recommend against relying solely on this information for financial, investment, property, or legal decisions, and we accept no responsibility for choices made based on this content.